FINANCIAL MANAGEMENT

CHECK POINT 52: CONTROL OF PURCHASES AND DISBURSEMENTS

This Check Point Is Available By Subscription Only,

But You Can Still Check Out The Menu Below. |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

FINANCIAL MANAGEMENT

CHECK POINT 52: CONTROL OF PURCHASES AND DISBURSEMENTS

Please Select Any Topic In Check Point 52 Below And Click. |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 52 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 52? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about Control Of Purchases And Disbursements and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• About steps in the purchases and disbursements control process.

• About three most popular accounting software programs.

• About purchase order information details.

• How to complete a purchase requisition.

• How to complete a purchase order.

• How to complete delivery note and invoice.

• How to complete a material received report.

• How to complete a check authorization.

• About internal control procedures for purchase of goods and services.

• About petty cash, creditors age analysis report. and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 52 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. THE PURCHASES AND DISBURSEMENTS CONTROL PROCESS |

|

|

INTERNAL CONTROL |

Business owners and financial managers must pay very close attention to control of cash, credit purchases, and disbursements within the organization on a continuous basis.

The vulnerability of Cash to fraud and embezzlement represents a serious problem for small and medium-sized companies where the separation of duties is less distinctive than in larger organizations. It is essential, therefore, to ensure continuous Control Of Purchases And Disbursements in order to minimize theft and financial mismanagement. This can be accomplished by developing and maintaining a strict control of purchases and disbursements in the organization, and particularly, within the financial department.

The Purchases And Disbursements Control Process entails a number of steps outlined below. |

THE PURCHASES AND DISBURSEMENTS CONTROL PROCESS |

Step 1: Complete A Purchase Requisition.

Purchase originator completes a purchase requisition specifying the required goods or services.

Step 2: Authorize The Purchase Requisition.

Head of the department authorizes the purchase requisition.

Step 3: Place A Purchase Order.

Buyer places a purchase order with a suitable supplier for the supply of goods or services.

Step 4: Accept The Delivery Of Goods.

The delivery of goods or services from supplier is received, inspected, and accepted.

Step 5: Issue Goods.

Goods are issued to the purchase requisition originator.

Step 6: Prepare Documentation.

All supporting documentation related to the delivery of goods or services is passed to the financial department for payment processing to the supplier. |

| |

The purchases and disbursements control process can be maintained manually or by using a specific accounting software program. |

| |

| POPULAR ACCOUNTING SOFTWARE PROGRAMS |

| There are several excellent Accounting Software Programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

|

• Sage One

• QuickBooks Intuit

• FreshBooks

• Harvest Software Systems

• NetSuite

|

| Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

2. PURCHASE REQUISITION AND PURCHASE ORDER |

|

|

PURCHASE REQUISITION AND PURCHASE ORDER |

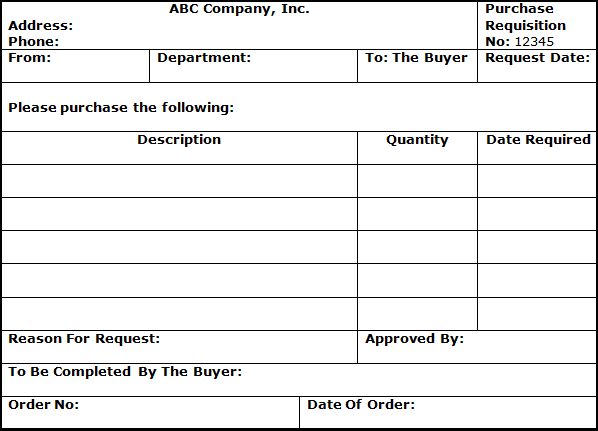

The control of purchases and disbursements should begin with an appropriate Purchase Requisition specifying the description and quantity of required items. The Purchase Requisition, illustrated below, must be authorized by the head of the department for which the materials or services are required. (Very small businesses may take a much less formal approach in this area and don't have to use unnecessary paperwork).

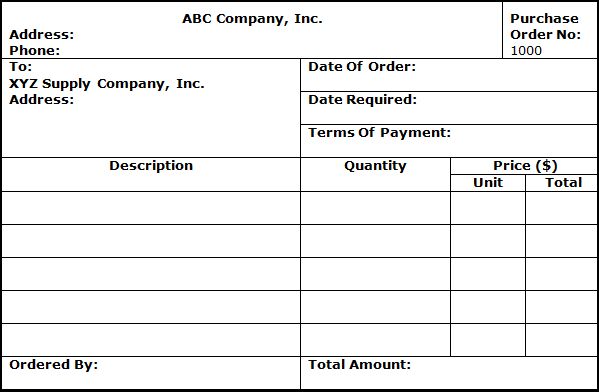

Upon approval, this requisition should be forwarded to the company's buyer, who is responsible for placing a Purchase Order with the most suitable Supplier, or Vendor. The purchase order, illustrated below, contains detailed information pertinent to the supply of goods or services. |

PURCHASE ORDER INFORMATION |

1. |

Description of goods or services. |

2. |

Quantity required. |

3. |

Unit cost, total price, terms of payment, and possible discounts. |

4. |

Delivery date required and other shipping instructions. |

|

|

|

3. SMALL BUSINESS EXAMPLE

PURCHASE REQUISITION |

|

|

PURCHASE REQUISITION |

|

|

|

4. SMALL BUSINESS EXAMPLE

PURCHASE ORDER |

|

|

PURCHASE ORDER |

|

|

|

5. DELIVERY NOTE AND INVOICE |

|

|

DELIVERY NOTE AND INVOICE |

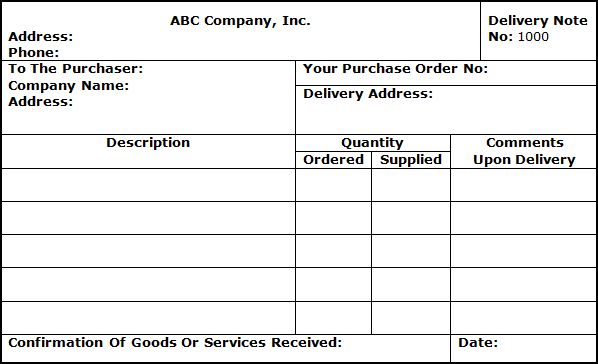

Upon receiving the purchase order, the supplier is expected to deliver the goods or to render services strictly in accordance with the details specified therein. Such a delivery should be accompanied by the supplier's Delivery Note or Bill Of Lading (in duplicate), or Invoice, or both.

The delivery note, illustrated below, contains a detailed description and an indication of the quantity of goods or services. The invoice, in addition, specifies the price and terms of payment as illustrated below. |

|

|

6. SMALL BUSINESS EXAMPLE

DELIVERY NOTE |

|

|

DELIVERY NOTE |

|

|

|

7. SMALL BUSINESS EXAMPLE

INVOICE |

|

|

INVOICE |

|

ABC Company, Inc.

Address:

Phone: |

Invoice No:

1000 |

To The Purchaser:

Company Name:

Address: |

Your Purchase Order No: |

Delivery Address: |

Description |

Quantity |

Price ($) |

Ordered |

Supplied |

Unit |

Total |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Terms Of Payment: |

Total Price: |

|

|

|

8. MATERIAL RECEIVED REPORT |

|

|

MATERIAL RECEIVED REPORT |

When Ordered Goods arrive in the company's stores, they must be immediately inspected and counted, if possible, by the storekeeper. The storekeeper should subsequently sign both delivery notes and return one copy to the supplier as a Proof Of Delivery.

In addition, the storekeeper must enter the relevant details pertaining to the delivered goods into the Materials Received Report, as illustrated below, and thereafter into the inventory control system (manual or computerized). At a later stage, the storekeeper must forward the second copy of the delivery note to the financial department for further processing of the transaction. |

|

|

9. SMALL BUSINESS EXAMPLE

MATERIAL RECEIVED REPORT |

|

|

MATERIAL RECEIVED REPORT |

ABC Company, Inc. |

Store: |

Location: |

Page No.1 |

|

Date |

Description |

Quantity Received |

Name

Of Supplier |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

10. CHECK AUTHORIZATION |

|

|

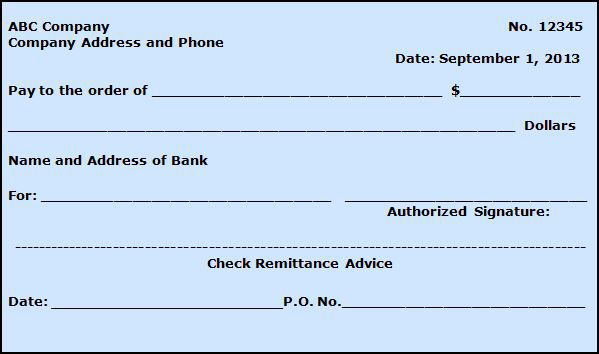

CHECK AUTHORIZATION |

In the financial department, the supplier's delivery note, a copy of the material received report, and invoice are compared with the company's purchase order and, if all is correct, a Check Authorization is completed.

Finally, check authorization, illustrated below, together with the three supporting documents must be forwarded to the company's treasurer, who should again examine the evidence and issue, or "cut" a check for the net amount of the invoice, i.e. gross amount less discount, if allowed.

Sometimes it is useful to send a check with an attached Remittance Advice, which indicates for what purpose the check is issued. This is also illustrated below. |

|

|

11. SMALL BUSINESS EXAMPLE

CHECK AUTHORIZATION |

|

|

CHECK AUTHORIZATION |

Document Description |

Reference |

Reference |

Reference |

Reference |

Purchase Requisition |

No: |

No: |

No: |

No: |

Delivery Note

and Invoice |

No: |

No: |

No: |

No: |

Material Received Report |

Page: |

Page: |

Page: |

Page: |

Total Price |

$ |

$ |

$ |

$ |

Less Discount |

$ |

$ |

$ |

$ |

Net Amount |

$ |

$ |

$ |

$ |

Approved For Payment |

Check No: |

Check No: |

Check No: |

Check No: |

Signature |

|

|

|

|

|

|

|

12. SMALL BUSINESS EXAMPLE

CHECK WITH ATTACHED REMITTANCE ADVICE |

|

|

CHECK WITH ATTACHED REMITTANCE ADVICE |

|

|

|

13. INTERNAL CONTROL PROCEDURES FOR PURCHASE OF GOODS OR SERVICES AND DISBURSEMENT OF CASH |

|

|

COMPUTERIZED INTERNAL CONTROL PROCEDURES |

| All Internal Control Procedures related to the purchase of goods or services and to the disbursement of cash should be continuously maintained by a suitable accounting software program in the financial department according to guidelines outlined below. |

| |

COMPUTERIZED INTERNAL CONTROL PROCEDURES

FOR PURCHASE OF GOODS OR SERVICES AND DISBURSEMENT OF CASH |

Document |

Prepared By |

Sent To |

Verification And Related Procedures |

1. |

Purchase Requisition |

Requesting department |

Purchasing department |

Purchasing department authorizes the purchase order. |

2. |

Purchase Order |

Purchasing department |

Supplier |

Supplier sends goods or services in accordance with the purchase order. |

3. |

Delivery

Note |

Supplier |

Receiving department |

Receiving department returns a signed copy of delivery note to supplier as proof of delivery. |

4. |

Invoice |

Supplier |

Accounting department |

Accounting department receives invoice from supplier. |

5. |

Receiving Report |

Receiving department |

Accounting department |

Accounting department compares invoice with the purchase order and receiving report, and verifies prices. |

6. |

Check Authorization |

Accounting department |

Bookkeeper |

Accounting department attaches check authorization to the invoice, purchase order, and receiving report. |

7. |

Check |

Bookkeeper |

Supplier |

Bookkeeper verifies all documents and if all is OK, issues a check. |

8. |

Deposit Ticket |

Supplier |

Supplier's bank |

Supplier receives a check and compares it with the invoice, and adjusts the accounts receivable file. Bank deducts the check from the buyer's account. |

9. |

Bank Statement |

Buyer's bank |

Accounting department |

Accounting department compares the amount and payee's name on the returned check with check authorization, and adjusts the accounts payable file. |

|

|

|

14. PETTY CASH FUND |

|

|

PETTY CASH FUND |

Although it is essential to issue checks for all payments, the company may need to pay cash for small items of service. For this reason, it is convenient to establish and to maintain a Petty Cash Fund. Cash for this fund is provided by drawing a check for a limited amount known as the Petty Cash Float.

The source of this float is provided in its entirety by the company's normal trading receipts, thus creating a single exception to the regular check payment procedure. Records of all petty cash transactions are entered into the Petty Cash Journal and controlled by means of the petty cash control account in the ledger. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

15. CREDITORS AGE ANALYSIS REPORT |

|

|

CREDITORS AGE ANALYSIS REPORT |

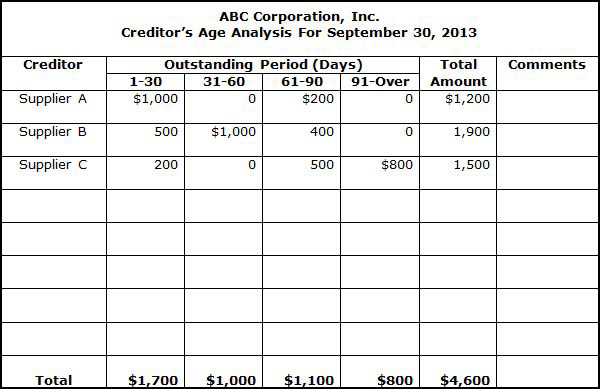

Control of cash disbursements and purchases also entails continuous monitoring of Accounts Payable to suppliers, or trade creditors, in order to ensure that the company does not over-commit itself financially. It is necessary, therefore, to establish and maintain thorough control of accounts payable and to summarize information that reflects the extent of the company's liabilities at any stage of trading.

It is essential to identify all accounts payable by the company to its suppliers, or trade creditors, and to summarize them in monthly Creditors Age Analysis Reports in accordance with the outstanding periods of time. These reports enable the financial manager to evaluate and control the level of accounts payable in accordance with the specific requirements of the company.

A typical example of Creditors Age Analysis Report is presented below. |

|

|

16. SMALL BUSINESS EXAMPLE

MONTHLY CREDITORS AGE ANALYSIS REPORT |

|

|

MONTHLY CREDITORS AGE ANALYSIS REPORT |

|

|

|

17. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

18. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

Whatever You Have - Spend Less!

Samuel Johnson

|

Go To The Next Open Check Point In This Promotion Program Online. |

| |

|