FINANCIAL MANAGEMENT

CHECK POINT 47: CAPITAL EXPENDITURE BUDGET

This Check Point Is Available By Subscription Only,

But You Can Still Check Out The Menu Below. |

|

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

FINANCIAL MANAGEMENT

CHECK POINT 47: CAPITAL EXPENDITURE BUDGET

Please Select Any Topic In Check Point 47 Below And Click. |

|

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 47 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 47? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about a Capital Expenditure Budget and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• About objectives of a capital expenditure budget.

• About a capital expenditure decision-making process.

• About the steps in the capital expenditure decision cycle.

• How to complete a capital expenditure requirements schedule.

• About preliminary analysis of capital expenditure requests.

• About capital expenditure acceptance-rejection standards.

• About final evaluation of capital expenditure proposals.

• About profitability of capital expenditure projects.

• About the accounting-rate-of-return method.

• About the payback period method. and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 47 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. OBJECTIVES OF A CAPITAL EXPENDITURE BUDGET |

|

|

CAPITAL INVESTMENT |

Business owners and financial managers must be fully familiar with various capital expenditure budgeting procedures to ensure a cost-effective performance by the organization.

Selection of appropriate capital investments represents an important managerial task in many small businesses.

A Capital Investment may be defined as the outlay of company cash for specific objectives with the expectation that the outlay will produce future profit and generate a positive cash flow.

Capital Investment Decisions represent an integral part of the overall financial planning process. They involve utilization of substantial company funds for a long period, a commitment that usually may be impossible or very difficult to reverse. Capital investment decisions are usually made for the following purposes outlined below. |

PURPOSE OF CAPITAL INVESTMENT |

1. |

Purchase of new capital assets, e.g. property, equipment, vehicles. |

2. |

Replacement of existing capital assets. |

3. |

Expansion of the current product and service range. |

4. |

Research and development of new products and services. |

5. |

Acquisition of an additional company. |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

2. THE CAPITAL EXPENDITURE DECISION-MAKING PROCESS |

|

|

THE CAPITAL EXPENDITURE DECISION-MAKING PROCESS |

The Capital Expenditure Decision-Making Process entails preparation of estimates pertaining to additional costs and potential benefits related to specific long-term projects. The ultimate objective of this process is the preparation of a comprehensive Capital Expenditure Budget.

The capital expenditure budget is an important financial document that summarizes estimated benefits and costs pertaining to the acquisition of capital assets or the participation in long-term projects.

A capital expenditure budget can be completed manually or by using a specific accounting software program.

|

| POPULAR ACCOUNTING SOFTWARE PROGRAMS |

| There are several excellent Accounting Software Programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

|

• Sage One

• QuickBooks Intuit

• FreshBooks

• Harvest Software Systems

• NetSuite

|

| Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

|

|

3. STEPS IN THE CAPITAL EXPENDITURE DECISION CYCLE |

|

|

THE CAPITAL EXPENDITURE DECISION CYCLE |

The capital expenditure decision-making process, or Capital Expenditure Decision Cycle, entails a number of steps outlined below. In a very small company this process may take a less formal approach, depending on the number of people involved. |

STEPS IN THE CAPITAL EXPENDITURE DECISION CYCLE |

Step 1: Identify Capital Investment Opportunities.

Step 2: Prepare Formal Request For Capital Expenditure.

Step 3: Conduct Preliminary Analysis Of The Request For Capital Expenditure.

Step 4: Set The Acceptance And Rejection Standards.

Step 5: Conduct Final Evaluation Of The Request For Capital Expenditure.

Step 6: Approve Or Reject The Request For Capital Expenditure. |

|

|

Step 8: Authorize The Implementation Of The Capital Expenditure Decision.

Step 9: Evaluate The Actual Benefits And Costs Of The Capital Expenditure Decision. |

|

|

|

4. CAPITAL EXPENDITURE REQUIREMENTS SCHEDULE |

|

|

CAPITAL EXPENDITURE REQUIREMENTS SCHEDULE |

The Capital Expenditure Decision Cycle starts with the identification of capital investment opportunities.

New ideas pertaining to Capital Investment Opportunities may be originated by managers in various departments. An operations manager, for example, can prepare a list of additional capital equipment that may substantially improve overall performance efficiency in the production department.

A marketing manager, on the other hand, can submit suggestions about new product lines to improve the company's position in the marketplace. These and similar proposals need to be examined in terms of short-, medium-, and long-term company objectives in order to summarize possible Capital Expenditure Requirements. |

|

|

5. SMALL BUSINESS EXAMPLE

CAPITAL EXPENDITURE REQUIREMENTS SCHEDULE |

|

|

CAPITAL EXPENDITURE REQUIREMENTS SCHEDULE |

Company Name: ABC Manufacturing Company

The Budget Period: January 1, 2014 - December 31, 2014 |

Product Description |

Quantity |

Price

Estimate

($) |

Date

Required |

1. New CNC Machine |

1 |

30,000 |

May 2013 |

2. New Milling Machine |

1 |

12,000 |

June 2013 |

3. New Press Brake |

2 |

3,000 x 2 |

July 2013 |

4. New Power Saw |

2 |

1,000 x 2 |

July 2013 |

5. New Paint Plant |

1 |

25,000 |

August 2013 |

Total Capital Expenditure |

7 |

75,000 |

- |

|

|

|

6. CAPITAL EXPENDITURE REQUEST |

|

|

CAPITAL EXPENDITURE REQUEST |

Once a detailed schedule of possible capital expenditure requirements is summarized, a formal Capital Expenditure Request needs to be prepared. This generally applies only to larger companies.

A capital expenditure request is prepared by an appropriate manager who is directly involved with a specific proposal. The proposed request should provide a Detailed Description pertaining to a particular long-term project, e.g. new product development, or acquisition of a new property. Additional details that should be included in this request are outlined below.

Obviously, very small companies may take a much less formal approach as long as all the relevant details are properly documented. The action described below will simply become a part of the preliminary Capital Expenditure Analysis. |

CAPITAL EXPENDITURE REQUEST DETAILS |

1. |

Calculation of the capital cost of the project and determination of its operational life period, e.g. equipment replacement study. |

2. |

Calculation of additional working capital required by the new project and determination of possible operating savings. |

3. |

A forecast of additional cash flow, i.e. cash receipts and cash payments - not revenues and expenses - arising out of the new project. |

4. |

A forecast of tax liability arising from additional earnings and possible tax savings accruing from the above investment. |

|

|

|

7. PRELIMINARY ANALYSIS OF CAPITAL EXPENDITURE REQUESTS |

|

|

PRELIMINARY ANALYSIS OF CAPITAL EXPENDITURE REQUESTS |

The bulk of Capital Expenditure Requests in small and medium-sized companies are concerned with purchase of new equipment and replacement of the old one. Such requests are usually prepared by the operations manager in accordance with a comprehensive equipment replacement program.

Development of Equipment Replacement Programs is discussed in detail in Tutorial 4.

Once all information pertaining to a specific request for capital expenditure is summarized, it should be analyzed by the financial manager. Preliminary Analysis Of Capital Expenditure Requests entails reviewing relevant details and ascertaining their compatibility with the company's short-, medium-, and long-term financial objectives and plans.

Without incurring excessive investigation costs, the financial manager provides a major contribution to this activity by identifying suitable and unsuitable proposals. |

|

|

8. CAPITAL EXPENDITURE ACCEPTANCE-REJECTION STANDARDS |

|

|

SETTING ACCEPTANCE-REJECTION STANDARDS FOR CAPITAL EXPENDITURE |

The next step in the capital expenditure decision cycle entails setting appropriate Capital Expenditure Acceptance-Rejection Standards for accepting and rejecting various proposals.

Setting of capital expenditure acceptance-rejection standards is particularly important for small and medium-sized companies with limited financial resources. The two most commonly used standards for capital expenditure acceptance or rejection are outlined below. |

CAPITAL EXPENDITURE ACCEPTANCE-REJECTION STANDARDS |

|

|

|

| Minimum Desired Rate Of Return |

|

Minimum Cash Flow Payback Period |

This is the lowest rate of return on capital expenditure acceptable to company shareholders.

|

|

This is the shortest period of time during which the company can generate additional cash flow equal to the value of capital expenditure. |

|

|

|

|

9. FINAL EVALUATION OF CAPITAL EXPENDITURE PROPOSALS |

|

|

FINAL EVALUATION OF CAPITAL EXPENDITURE PROPOSALS |

The following step in the capital expenditure decision cycle entails final evaluation of capital expenditure proposals. This involves verifying the accuracy of the following Capital Expenditure Proposal Parameters illustrated below. |

THE FINAL EVALUATION OF CAPITAL EXPENDITURE PROPOSALS PARAMETERS |

|

|

|

|

|

Operating

Costs |

|

The Estimated

Operating Life Period |

|

The Salvage

Value |

The operating costs include materials, labor, and overheads. |

|

This is the estimated operating life period of the proposed equipment or investment. |

|

This is the estimated value which may be received upon the disposal of the proposed equipment or investment. |

|

|

| |

IMPORTANCE OF THE CAPITAL EXPENDITURE PROPOSAL EVALUATION |

Final evaluation of Capital Expenditure Proposals is essential in a meaningful investment appraisal and provides a guarantee for sound management decisions. Thus, it is important to allocate sufficient time and effort to ensure a high quality of information, thereby avoiding unnecessary and potentially costly mistakes.

Another important factor that should be considered during the capital expenditure decision cycle is the effect of income taxes on the company's cash flow and profitability. Additional information related to selection of suitable Tax Strategies are discussed in detail in Tutorial 3. |

|

|

10. PROFITABILITY OF CAPITAL EXPENDITURE PROJECTS |

|

|

There are several methods of measuring the Profitability Of Capital Expenditure Projects, as illustrated below. |

THREE METHODS FOR MEASURING

THE PROFITABILITY OF CAPITAL EXPENDITURE PROJECTS |

|

|

|

|

|

The Accounting

Rate-Of-Return

Method |

|

The Payback

Period

Method |

|

The Discounted

Cash Flow

Method |

|

|

|

|

11. THE ACCOUNTING RATE-OF-RETURN METHOD |

|

|

THE ACCOUNTING RATE-OF-RETURN METHOD |

The Accounting Rate-Of-Return Method is a crude, but simple, approach for evaluating the economic viability of capital investment. Because of its simplicity, the Accounting Rate-Of-Return Method is often used to obtain a preliminary indication of the suitability of the proposed capital expenditure.

This method provides a measure for expected capital expenditure performance by using two variables:

1. Estimated annual after-tax net income from the project.

2. Average investment cost.

The basic equation for determining the Accounting Rate Of Return by applying these variables is as follows:

Accounting Project's Average Annual

Rate = After-Tax Net Income

Of Return Average Investment Cost

Or:

Accounting (A - B) x (1.0 - C)

Rate = (D - E) + E

Of Return 2 |

KEY |

A |

Projected annual cash revenue generated from the capital equipment (in $). |

B |

Projected operating cost of running the capital equipment (in $). |

C |

Projected company's income tax rate (% /100). |

D |

Total investment cost (in $). |

E |

Projected salvage value, i.e. equipment value at the end of its service life (in $). |

|

|

|

12. SMALL BUSINESS EXAMPLE

ACCOUNTING RATE-OF-RETURN CALCULATION |

|

|

ACCOUNTING RATE-OF-RETURN CALCULATION |

Assume, for example, that ABC Corporation is considering the purchase of new equipment and these are the projected values:

• A = $13,500

• B = $6,000

• C = 0.3 i.e. (30%/100)

• D = $30,000

• E = $5,000

Accounting Rate Of Return is determined as follows:

Accounting Rate = ($13,500 - $6,000) x (1.0 - 0.3)

Of Return ($30,000 - $5,000) + $5,000

2

or

Accounting Rate Of Return = $5,250 = 30%

$17,500

Management should desire a rate of return on capital expenditure at least 10% above the annual rate of inflation.

Thus, if the rate of inflation is about 5%, the desired rate on capital expenditure return should be at least 15%. Since the accounting rate of return in the above example is 30%, it provides a positive indication of the economic viability of the proposed plan. |

|

|

13. DRAWBACKS OF THE ACCOUNTING RATE-OF-RETURN METHOD |

|

|

ACCOUNTING RATE-OF-RETURN METHOD |

Despite its simplicity, the Accounting Rate-Of-Return Method has several drawbacks outlined below. |

DRAWBACKS OF THE ACCOUNTING RATE-OF-RETURN METHOD |

1. |

The use of average values tends to equalize relevant data, thereby leading to possible inaccuracy in the calculation. |

2. |

This method does not provide reliable results when estimated annual net income fluctuates from one year to the next. |

3. |

The future devaluation of the dollar is not accounted for in this method, i.e. the present and future amounts are treated as having equal value of purchasing power. |

|

|

|

14. THE PAYBACK PERIOD METHOD |

|

|

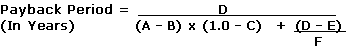

THE PAYBACK PERIOD METHOD |

The Payback Period Method is the second method for measuring the economic viability of a specific capital expenditure proposal. This method is concerned with measuring the period of time it will take to recuperate the capital investment from future cash inflows.

The Payback Period can be determined as follows:

Payback Period Total Investment Cost (In $)

(In Years) = Average Annual Net Cash Inflow (In $)

Where:

Average Project’s Total

Annual Average Investment - Salvage

Net Cash = Annual + Cost Value

Inflow After-Tax Service Life Period (In Years)

(In $) Net Income

Or:

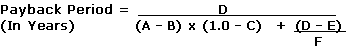

|

KEY |

A |

Projected annual cash revenue generated from the capital equipment (in $). |

B |

Projected operating cost of running the capital equipment (in $). |

C |

Projected company's income tax rate (% /100). |

D |

Total investment cost (in $). |

E |

Projected salvage value, i.e. equipment value at the end of its service life (in $). |

F |

Service life period (in years). |

|

|

|

15. SMALL BUSINESS EXAMPLE

PAYBACK PERIOD CALCULATION |

|

|

PAYBACK PERIOD CALCULATION |

The application of the Payback Period Method can be illustrated by using data from the previous example. Assume that ABC Corporation is considering to purchase new equipment with an estimated service period of 10 years, and these are the projected values:

• A = $13,500

• B = $6,000

• C = 0.3 i.e. (30%/100)

• D = $30,000

• E = $5,000

• F = 10 years

The Payback Period can be determined as follows:

$30,000 ____ =

($13,500 - $6,000) x (1.0 - 0.3) + ($30,000 - $5,000)

10 years

= $30,000 = 3.8 years.

$7,750

If the desired payback period on capital expenditure is four to five years, then this proposal could be acceptable to the company's management.

Although the Payback Period Method is simple in application and is widely used by managers, it also has several drawbacks. These drawbacks are similar to the ones discussed earlier in the context of the Accounting-Rate-Of Return Method. |

|

|

16. THE DISCOUNTED CASH FLOW METHOD |

|

|

THE DISCOUNTED CASH FLOW METHOD |

The Discounted Cash Flow Method is the most accurate method for measuring the economic viability of a specific capital expenditure proposal. Unfortunately, this method is also more complicated than the two previous methods.

Instead of measuring the accounting rate of return or payback period on a particular investment, this method measures Present Cash Flow values generated from such an investment. This approach to capital investment analysis is termed the Present-Value Method.

The Discounted Cash Flow Method entails the use of Present-Value Tables (Table A-1, Table A-2, Table A-3, and Table A-4) which are provided below. Each table contains a Series Of Multipliers that help determine the Present Value of the Future Cash Flow.

This process is called Cash Flow Discounting and it has two basic variables outlined below. |

TWO VARIABLES IN THE DISCOUNTED CASH FLOW METHOD |

1. |

Annual interest rate or minimum desired rate of return. |

2. |

A period of time during which the cash flow is discounted. |

|

This cash flow discounting process also has two important parameters outlined below. |

TWO IMPORTANT PARAMETERS IN THE DISCOUNTED CASH FLOW METHOD |

1. |

Net Present Value (NPV).

What is the net present value of a particular investment which will be paid off in the future? |

2. |

Internal Rate Of Return (IRR).

What is the current net rate of return on investment which will be paid off in the future? |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

17. SMALL BUSINESS EXAMPLE

APPLICATION OF PRESENT-FUTURE VALUE TABLES |

|

|

APPLICATION OF PRESENT-FUTURE VALUE TABLES |

Typical Examples Of Cash Flow Discounting Are illustrated Below |

1. |

Determine the future value of $1,000 deposited now that will earn 10% interest compounded annually for 5 years.

- • From Table A-1, the necessary Multiplier for 5 years at 10% is 1.611.

- • Hence the answer is: $1,000 x 1.611 = $1, 611.

|

2. |

Determine the future value at the end of 5 years if $1,000 is deposited

annually on January 1, assuming 10% interest compounded annually.

- • From Table A-2, the necessary Multiplier is 6.105.

- • Hence, the answer is: $1,000 x 6.105 = $6,105.

|

3. |

Determine the present value of $1,000 to be received five years from now, assuming a 10% annual interest rate.

- • From Table A-3, the necessary Multiplier is 0.621.

- • Hence, the answer is: $1,000 x 0.621 = $621.

|

4. |

Determine the present value of a $1,000 total investment, payable in five equal annual installments, assuming a 10% annual interest rate.

- • From Table A-4, the necessary Multiplier is determined as follows:

- • If the first installment is paid now, the multiplier is determined for a period N - 1, i.e. 4 years at the same interest rate. The answer is

$1,000 + $1,000 x 3,170 = $834

5 5

- • If the first installment is paid one year from now, the Multiplier is determined for a full period N, i.e. 5 years at the same interest rate. The answer is

$1,000 x 3.791 = $758.2

5

|

|

The above examples clearly illustrate fluctuation of present and future values depending upon the annual interest rate and the period of time during which the cash flow is discounted.

An additional example below will help to illuminate the application of the Discounted Cash Flow Method for evaluating capital expenditure proposals. (4) |

|

|

18. SMALL BUSINESS EXAMPLE

THE DISCOUNTED CASH FLOW METHOD |

|

|

THE DISCOUNTED CASH FLOW METHOD |

|

Suppose ABC Corporation needs to make an investment decision pertaining to two machines on the basis of the following information outlined below. |

Description |

Machine 1 |

Machine 2 |

Purchase Price on 01.01.2013 |

$17,000 |

$17,000 |

Salvage Value |

0 |

0 |

Expected Service Life Period |

5 years |

5 years |

Desired Annual Rate Of Return |

20% |

20% |

| |

Estimated Net Annual Cash Inflow For Each Machine |

Year 2013 |

$6,000 |

$4,000 |

2014 |

$6,000 |

$5,000 |

2015 |

$6,000 |

$6,000 |

2016 |

$6,000 |

$7,000 |

2017 |

$6,000 |

$8,000 |

|

| |

THE DISCOUNTED CASH FLOW METHOD APPLICATION |

Evaluation Of Machine 1 |

Machine 1 is expected to generate equal annual net cash inflow of $6,000 per year over the next five years.

The present value of the cash inflow can be determined from Table A-4 by using 20% annual interest rate as shown below. |

Description |

Present Value Of Cash Inflow |

(+) |

Present Value Of Cash Inflows |

$6,000 x 2.991 = $17,946 |

(--) |

Purchase Price of The Machine |

($17,000) |

(=) |

Net Present Value Of Cash Inflow |

$946 |

|

| |

Evaluation Of Machine 2 |

Machine 2 is expected to generate unequal annual net cash inflow ranging from $4,000 to $8,000 per year over the next five years.

The present value of the cash inflows can be determined from Table A-3 by using 20% annual interest rate as shown below. |

Description |

Present Value Of Cash Inflow |

(+) |

Year 2010 |

$4,000 x 0.833 = $3,332 |

(+) |

Year 2011 |

$5,000 x 0.694 = $3,470 |

(+) |

Year 2012 |

$6,000 x 0.579 = $3,474 |

(+) |

Year 2013 |

$7,000 x 0.482 = $3,216 |

(+) |

Year 2014 |

$8,000 x 0.402 = $3,216 |

(=) |

Total Cash Inflows |

$16,866

|

(--) |

Purchase Price Of The Machine |

($17,000) |

(=) |

Net Present Value Of Cash Inflow |

($134) |

|

| |

Conclusion |

It is apparent from this example that Machine 1 is expected to generate a positive Net Present Value Of Cash Inflow of $946, which is economically more viable than Machine 2 which is expected to generate a negative Net Present Value of Cash Inflow of $134. |

|

|

19. COMPOUND INTEREST AND PRESENT VALUE TABLE A-1 |

|

|

|

|

© Needles, B.E., Jr., H.R. Anderson, J.C. Caldwell, and Mills, S.K., Financial & Managerial Accounting, 4th ed. pp. AP-38 - AP-43. Copyright 1996 by Houghton Mifflin Company. Used with permission. All rights reserved |

|

|

20. COMPOUND INTEREST AND PRESENT VALUE TABLE A-2 |

|

|

|

© Needles, B.E., Jr., H.R. Anderson, J.C. Caldwell, and Mills, S.K., Financial & Managerial Accounting, 4th ed. pp. AP-38 - AP-43. Copyright 1996 by Houghton Mifflin Company. Used with permission. All rights reserved. |

|

|

21. COMPOUND INTEREST AND PRESENT VALUE TABLE A-3 |

|

|

|

|

©Needles, B.E., Jr., H.R. Anderson, J.C. Caldwell, and Mills, S.K., Financial & Managerial Accounting, 4th ed. pp. AP-38 - AP-43. Copyright 1996 by Houghton Mifflin Company. Used with permission. All rights reserved. |

|

|

22. COMPOUND INTEREST AND PRESENT VALUE TABLE A-4 |

|

|

|

|

© Needles, B.E., Jr., H.R. Anderson, J.C. Caldwell, and Mills, S.K., Financial & Managerial Accounting, 4th ed. pp. AP-38 - AP-43. Copyright 1996 by Houghton Mifflin Company. Used with permission. All rights reserved. |

|

| |

| |

|

23. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

24. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

A Good Capital Budget Can Make A Capital Difference!

|

Go To The Next Open Check Point In This Promotion Program Online |

| |

|