FINANCIAL MANAGEMENT

CHECK POINT 56: PAYROLL ACCOUNTING

This Check Point Is Available By Subscription Only,

But You Can Still Check Out The Menu Below. |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

FINANCIAL MANAGEMENT

CHECK POINT 56: PAYROLL ACCOUNTING

Please Select Any Topic In Check Point 56 Below And Click. |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 56 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 56? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about Payroll Accounting and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• About elements of a payroll accounting system.

• About most popular accounting and payroll software programs.

• About applications of a payroll accounting system.

• About liabilities for employee compensation.

• About various types of compensation - wages, salaries, and commissions.

• About liabilities for employee payroll withholdings.

• About FICA tax, federal income tax, state income tax, and other deductions.

• How to prepare weekly employee slips and maintain employee earnings records.

• About liabilities for employer payroll taxes.

• About independent contractors... and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 56 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. ELEMENTS OF A PAYROLL ACCOUNTING SYSTEM |

|

|

PAYROLL ACCOUNTING SYSTEM |

Business owners and financial managers must be fully familiar with the development, implementation, and maintenance of an effective payroll accounting system, which is one of the prime managerial responsibilities in every company.

One of the major operating expenses incurred by most companies relates to Salaries, Wages, and Commissions paid and benefits provided to employees. In fact, in many labor-intensive manufacturing and service industries, the Payroll Cost represents the largest operating expense.

Hence, one of the important tasks of financial management is development, implementation, and maintenance of an effective Payroll Accounting System. An ordinary payroll accounting system is associated with three general types of liabilities illustrated below.(17) |

ELEMENTS OF A PAYROLL ACCOUNTING SYSTEM |

|

|

|

|

|

Liabilities

For Employee

Compensation |

|

Liabilities

For Employee

Payroll

Withholdings |

|

Liabilities

For Employer

Payroll

Taxes |

|

|

| |

| The payroll accounting system is usually maintained by using a specific accounting software program. |

| |

| POPULAR ACCOUNTING SOFTWARE PROGRAMS |

| There are several excellent Accounting Software Programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

|

• Sage One

• QuickBooks Intuit

• FreshBooks

• Harvest Software Systems

• NetSuite

|

| Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

2. APPLICATIONS OF A PAYROLL ACCOUNTING SYSTEM |

|

|

APPLICATIONS OF A PAYROLL ACCOUNTING SYSTEM |

The Payroll Accounting System concerns solely those individuals who are directly employed, supervised, controlled, and paid by the company. Such individuals, or Employees, may receive compensation in one of the following forms illustrated below. |

THREE TYPES OF COMPENSATION TO EMPLOYEES |

|

|

|

|

|

Hourly Wages,

Paid Weekly |

|

Salaries,

Paid Bi-Weekly

Or Monthly |

|

Commissions,

Paid Weekly

Or Bi-Weekly |

|

|

The frequency of any of the above payments will be in accordance with the specific agreement between the company and the employee. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

3. LIABILITIES FOR EMPLOYEE COMPENSATION |

|

|

EMPLOYEE COMPENSATION |

Liabilities For Employee Compensation include three types of payments by the company to its employees illustrated below. Each type is discussed in details next. |

LIABILITIES FOR EMPLOYEE COMPENSATION |

|

|

|

|

|

| Wages |

|

Salaries |

|

Commissions |

|

|

|

|

4. WAGES |

|

|

WAGES |

Wages are paid to employees for their work in the company at an hourly rate or on a piece-work basis.

The Fair Labor Standards Act Of 1938, as amended in 1983, specifies a minimum hourly wage rate, maximum working time of 40 hours per week, overtime pay equal to 1.5 times normal wage rate, child labor provisions, and record-keeping requirements. In addition, this law prescribes special overtime pay arrangements for work on Saturdays, Sundays, and public holidays.

The Current Federal Minimum Wage Rate, effective July 2009, is $7.25 per hour. However, this rate may be higher in some states, depending upon the specific state laws. In California, for example, the current minimum wage rate is $8 per hour. Please check, therefore, the Minimum Hourly Rate Wage In Your State. |

ADDITIONAL INFORMATION ONLINE |

You can obtain the updated information about the current minimum hourly wage rate in your state and other related issues provided by the U.S. Department Of Labor online. |

|

|

5. PAYROLL TIMECARD |

|

|

PAYROLL EXAMPLE |

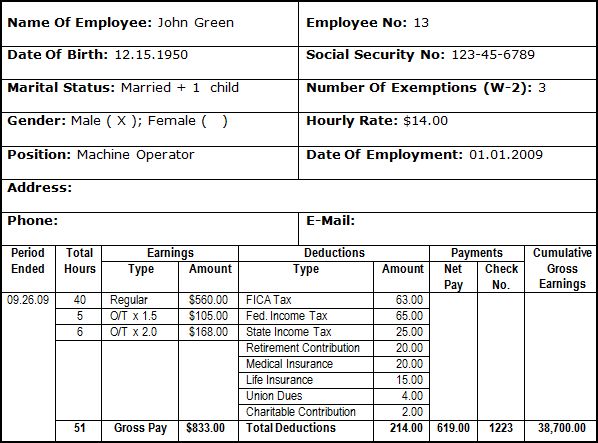

Consider, for example, that employee John Green is employed on the following basis outlined below. |

PAYROLL INFORMATION |

1. |

Regular wage: $14.00 per hour. |

2. |

Overtime wage: 1.5 x $14.00 = $21.00 per hour. |

3. |

Saturdays, Sundays, and public holidays: 2.0 x $14.00 = $28.00 per hour. |

4. |

Regular weekly time: 8 hours per day x 5 days per week = 40 hours per week. |

5. |

Regular monthly time: 40 hours per week x 4.3 = 172 hours per month. |

|

The total weekly wage earned by John Green depends upon the number of hours worked during a specific week, as reflected in the Weekly Payroll Timecard below. |

|

|

6. SMALL BUSINESS EXAMPLE

WEEKLY PAYROLL TIMECARD |

|

|

WEEKLY PAYROLL TIMECARD

|

Company: ABC Manufacturing Company, Inc. |

Name: John Green |

Employee No: 13 |

Department: Operations Department |

Pay Period: 09. 21. 2013 – 09.26.2013 |

Day |

Morning |

Afternoon |

Overtime |

Hours |

| |

In |

Out |

In |

Out |

In |

Out |

Regular |

Overtime |

Monday |

8:01 |

12:00 |

1:00 |

5:00 |

5:00 |

7:04 |

8 |

2 |

Tuesday |

7:58 |

12:02 |

1:02 |

5:03 |

|

|

8 |

0 |

Wednesday |

7:59 |

12:00 |

1:01 |

5:05 |

5:05 |

7:03 |

8 |

2 |

Thursday |

8:02 |

12:01 |

1:00 |

5:02 |

5:02 |

6:02 |

8 |

1 |

Friday |

8:03 |

12:03 |

1:00 |

5:00 |

|

|

8 |

0 |

Saturday |

8:01 |

12:04 |

|

|

|

|

|

4 |

Sunday |

8:00 |

10:03 |

|

|

|

|

|

2 |

Description |

Hours |

Rate |

Amount |

Regular |

40 |

$14.00 |

$560.00 |

Overtime x 1.5 |

5 |

$21.00 |

$105.00 |

Overtime x 2.0 |

6 |

$28.00 |

$168.00 |

Total Hours |

51 |

Total Pay |

$833.00 |

|

|

|

7. SALARY |

|

|

SALARY |

Salary refers to fixed amounts of compensation paid to managerial, administrative, and sales employees on a bi-weekly or monthly basis.

Full-time salaried employees are expected to work at least 40 hours per week or longer, depending on the workload within the company. When salaried employees work Overtime, they usually do not get additional pay. Diligence and commitment of employees, however, should be compensated when their salaries are reviewed by management. |

|

|

8. COMMISSION |

|

|

COMMISSION |

Commission is another form of compensation that can be paid to the company's employees for their work.

Commissions are usually paid to sales people in accordance with their sales performance. In this instance, commissions are often coupled with basic monthly salaries. Moreover, commissions may be paid to supervisors in the form of a Bonus for efficient performance by their section or department. |

|

|

9. COMMISSION RECORD |

|

|

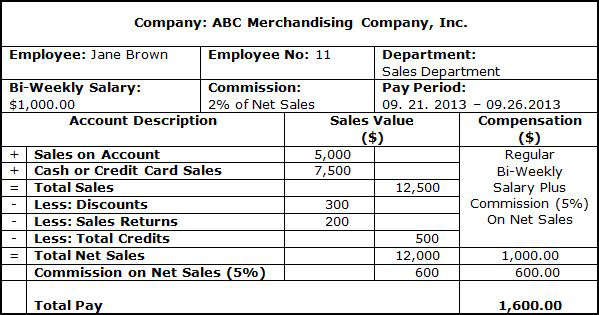

COMMISSION RECORD |

Consider, for example, that Jane Brown is employed as a sales person and receives a basic bi-weekly salary of $1,000 and 5% sales commission on all net sales generated by her. The total payment due to Jane Brown is summarized in a Commission Record on a bi-weekly basis.

A typical Commission Record is presented below. |

|

|

10. SMALL BUSINESS EXAMPLE

COMMISSION RECORD |

|

|

|

|

11. LIABILITIES FOR EMPLOYEE PAYROLL WITHHOLDINGS |

|

|

LIABILITIES FOR EMPLOYEE PAYROLL WITHHOLDINGS |

Liabilities For Employee Payroll Withholdings represent a second major element of an ordinary payroll accounting system. These liabilities include all deductions that must be withheld by law from employees' earnings and sent directly to the appropriate government agencies. This group of liabilities includes three types illustrated below. |

THREE TYPES OF LIABILITIES FOR EMPLOYEE PAYROLL WITHHOLDINGS |

|

|

|

|

|

FICA

Tax Deductions |

|

Federal

Income Tax |

|

State

Income Tax |

|

|

Additional Withholdings made from employees' earnings relate to various benefit programs designed for employees. These withholdings may include the following types, as illustrated below. |

ADDITIONAL WITHHOLDINGS MADE FROM EMPLOYEES' EARNINGS |

|

|

|

|

|

Retirement

Payments |

Medical

Insurance

Premiums |

Life

Insurance

Premiums |

Union

Dues |

Charitable

Contributions |

|

|

| |

You can find additional information at Internal Revenue Service online or consult with your accountant or CPA. |

|

|

12. FICA TAX DEDUCTIONS |

|

|

FICA TAX DEDUCTIONS |

| FICA Tax Deductions must be withheld from every employee's earnings in accordance with The Federal Insurance Contributions Act (FICA). The prime purpose of FICA tax is to provide the federal government with additional funds in support of the U.S. Social Security Program.

This program offers retirement and disability benefits, medical and hospitalization benefits, and survivor's benefits. In addition to funds withheld from employees, this program is also financed by funds paid by employers and self-employed individuals.

The employer must deduct FICA Tax from each employee's wages, add an equal amount contributed by the company, and deposit the total amount with the government.

Note:

You can find additional information at Internal Revenue Service online or consult with your accountant or CPA. |

|

|

13. FEDERAL INCOME TAX |

|

|

FEDERAL INCOME TAX |

Federal Income Tax is the largest deduction from most employees' earnings. This tax must be withheld from each employee's earnings by the employer on the basis of "Pay As You Earn" (PAYE) and sent to Internal Revenue Service (IRS).

The amount of the federal income tax withheld depends upon the employee's Gross Earnings and the Number Of Exemptions. Employees are required by law to indicate their exemptions by completing Employee's Withholding Exemption Certificate (Form W-4).

In accordance with The Tax Reform Act Of 1986, each employee is entitled to one exemption for himself or herself and one exemption for each dependent, e.g. spouse and children. IRS provides employers with a Wage Bracket Table to calculate the correct amount of Federal Income Tax withheld.

Note:

You can find additional information at Internal Revenue Service and BizFilings online or consult with your accountant or CPA. |

|

|

14. STATE INCOME TAX |

|

|

STATE INCOME TAX |

State Income Tax is an additional deduction from employees' earnings and is regulated by the existing laws in a specific state.

Most states require that employers withhold certain amounts from their employees' earnings and send these taxes to Internal Revenue Service. You can determine specific State Income Tax Rates in your state at Tax-Rates online.

Note:

You can find additional information at Internal Revenue Service online or consult with your accountant or CPA. |

|

|

15. ADDITIONAL DEDUCTIONS FROM EMPLOYEE EARNINGS |

|

|

DEDUCTIONS |

Other Deductions from employee earnings have been mentioned earlier and include five types illustrated below. |

ADDITIONAL DEDUCTIONS FROM EMPLOYEE EARNINGS |

|

|

|

|

|

Retirement

Payments |

Medical

Insurance

Premiums |

Life

Insurance

Premiums |

Union

Dues |

Charitable

Contributions |

These include all contributions by an employee to his or her retirement plan, such as 401(k). |

These include all contributions by an employee to his or her for medical insurance, such as Blue Cross, Blue Shield. |

These include all premiums by an employee for life insurance policies issued on the employee's life. |

These include all contributions which must be made by the employee to a labor union. |

These include contributions to any charity which the employee may select. |

|

|

Some of these and other Deductions are compulsory, while others are made at the employee requests. Irrespective of the reason for a particular deduction, the employer is liable to account for each deduction and maintain accurate accounting records.

Note:

You can find additional information at Internal Revenue Service online or consult with your accountant or CPA. |

|

|

16. WEEKLY PAY SLIP |

|

|

WEEKLY PAY SLIP |

Once all deductions are determined, the final amount paid to employees, or Net Earnings, can be calculated.

Continuing with the previous example, and assuming specific amounts of deductions withheld from John Green's Weekly Wages, the final amount of net earnings can be summarized on a Weekly Pay Slip as illustrated below. |

|

|

17. SMALL BUSINESS EXAMPLE

WEEKLY PAY SLIP |

|

|

WEEKLY PAY SLIP |

Company: ABC Manufacturing Company, Inc. |

Department: Operations Department. |

Employee Name:

John Green |

Employee No: 13 |

Pay Period:

09. 21. 2013 – 09.26.2013 |

Deductions |

Amount

($) |

Pay Description |

Amount

($) |

| + |

FICA Tax |

63.00 |

+ |

Gross Weekly Wages |

$833.00 |

| + |

Federal Income Tax |

65.00 |

- |

Total Deductions |

214.00 |

| + |

State Income Tax |

25.00 |

= |

Net Earnings |

619.00 |

| + |

Retirement Contribution |

20.00 |

Message From Management:

We sincerely appreciate your working efforts during the last week.

Thank you,

Peter Brown, Supervisor. |

| + |

Medical Insurance Premium |

20.00 |

| + |

Life Insurance Premium |

15.00 |

| + |

Union Dues |

4.00 |

| + |

Charitable Contributions |

2.00 |

| = |

Total Deductions |

214.00 |

|

|

|

18. EMPLOYEE EARNINGS RECORD |

|

|

EMPLOYEE EARNINGS RECORD |

An effective payroll accounting system entails maintaining accurate and updated Employee Earnings Records pertaining to the earnings of each employee. These records can be maintained manually or by using a specific Accounting Software Program as discussed in detail in Tutorial 3.

The Cumulative Gross Earnings must be also reflected in this record and summarized at the end of the fiscal year. This helps the employer to comply with the rule of applying FICA Taxes only to the Maximum Wage Level.

An example of a typical Employee Earnings Record is presented below. This record reflects all details pertaining to three elements of employee compensation outlined below. |

ELEMENTS OF THE EMPLOYEE EARNINGS RECORD |

|

|

|

|

|

| Weekly Gross Earnings |

|

Deductions |

|

Net Earnings |

|

|

| |

WAGE AND TAX STATEMENT (FORM W-2) |

Moreover, at the end of the year, the employer must complete a Wage And Tax Statement (Form W-2) summarizing total gross earnings and deductions for each employee.

This will enable each employee to prepare his or her individual Tax Returns at the end of the period prescribed by IRS. The employer must also submit a copy of the W-2 Form to IRS to enable the latter to verify information submitted by employees.

Note:

You can find additional information at Internal Revenue Service online or consult with your accountant or CPA. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

19. SMALL BUSINESS EXAMPLE

EMPLOYEE EARNINGS RECORD |

|

|

EMPLOYEE EARNINGS RECORD |

|

|

|

20. EMPLOYEE PAYROLL MODULE |

|

|

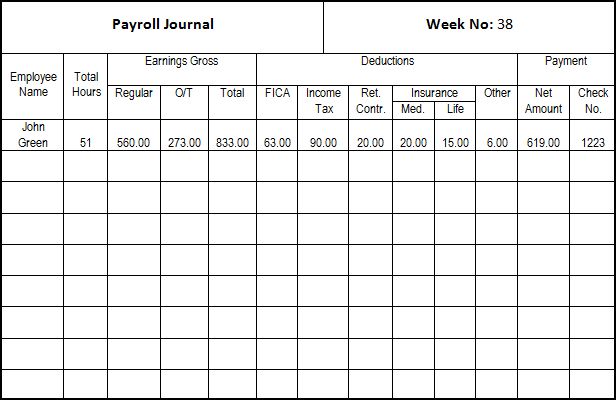

ELEMENTS OF AN EMPLOYEE PAYROLL MODULE |

Most Accounting Software Programs include an Employee Payroll Module, which will enable the financial manager or bookkeeper to enter various transactions related to employee payroll on a regular basis. This may include the following:

• Setting hourly wages, monthly salaries, and commissions.

• Paying weekly wages, monthly salaries, and commissions.

• Making direct payroll deposits.

• Making 401(k) deductions.

• Calculating payroll taxes.

• Printing W-2 and W-3 Forms.

• Printing 941 and 940 Forms.

• Setting employee status as active or inactive.

An employee payroll module will provide you and your management team with accurate and updated Employee Payroll Records for each employee within your company.

The information contained in the employee payroll module reflects all details pertaining to weekly gross earnings, monthly salaries, commissions, deductions, and subsequent Net Payments to employees. A typical Employee Payroll Record is illustrated below.

|

EMPLOYEE PAYROLL RECORD |

|

|

|

21. LIABILITIES FOR EMPLOYER PAYROLL TAXES |

|

|

LIABILITIES FOR EMPLOYER PAYROLL TAXES |

Liabilities For Employer Payroll Taxes represent the final element of an ordinary payroll accounting system. These liabilities include all contributions that, by law, must be paid by the employer and sent directly to the appropriate government agencies. This group of liabilities includes three types illustrated below. |

THREE TYPES OF LIABILITIES FOR EMPLOYER PAYROLL TAXES |

|

|

|

|

|

FICA

Tax

Contributions |

|

Federal

Unemployment

Insurance Tax |

|

State

Unemployment

Insurance Tax |

|

|

|

|

22. FICA TAX CONTRIBUTIONS |

|

|

FICA TAX CONTRIBUTIONS |

FICA Tax Contributions must be paid by the employer in accordance with The Federal Insurance Contribution Act (FICA). The total amount of FICA tax contributions payable by the employer equals the total amount of FICA deductions withheld from all employees.

For example, if total FICA Tax deductions from all employees during one week equals to $100, the employer must add another $100 and send a check for $200 to the government. FICA tax checks must be paid at least once every three month or more frequently, depending upon the amount of tax involved.

Note:

You can find additional information at Internal Revenue Service online or consult with your accountant or CPA. |

|

|

23. FEDERAL UNEMPLOYMENT INSURANCE TAX |

|

|

FEDERAL UNEMPLOYMENT INSURANCE TAX |

Federal Unemployment Insurance Tax must be paid by the employer in accordance with Federal Unemployment Tax Act (FUTA)

This is another part of the U.S. Social Security Program aimed at providing financial help to unemployed workers. Unlike FICA taxes, which are imposed on both, employers and employees, FUTA tax is generally levied only on employers (in most states).

The amount of FUTA Tax may vary from one state to another. Moreover, the employer may receive credit against FUTA tax for unemployment taxes paid to the state. FUTA tax must be paid once a year if the amount of tax is less than $100. Larger amounts of FUTA tax are paid quarterly.

Note:

Please check current rates with Internal Revenue Service online or consult with your accountant or CPA. |

|

|

24. STATE UNEMPLOYMENT INSURANCE |

|

|

STATE UNEMPLOYMENT INSURANCE TAX |

State Unemployment Insurance Tax must be paid by the employer if it is prescribed by the legislation of a particular state. This tax is levied on the employer in a manner, similar to FUTA tax, and it is used for the same purposes.

State unemployment insurance tax is subject to change on an annual basis and it may fluctuate from one state to another. Furthermore, companies with good Employment Records may enjoy the benefit of reduced state unemployment tax rates in some states. The payment dates for state unemployment insurance taxes also vary from one state to another.

Note:

Please check current rates with Internal Revenue Service online or consult with your accountant or CPA. |

|

|

25. WHO ARE INDEPENDENT CONTRACTORS? |

|

|

INDEPENDENT CONTRACTORS |

The payroll accounting system does not apply to outside contractors, who may provide the company with a wide range of services, e.g. secretarial, consulting, or plumbing. These contractors, also known as Independent Contractors, are paid by the company on a pre-arranged fee basis.

In accordance with the IRS requirements the company must "1099" all independent contractors at the end of the fiscal period. This entails issuing all independent contractors with a 1099 Tax Form and specifying the total amount paid during the fiscal period to a particular recipient.

The recipient's Social Security Number (for individuals), or Tax Identification Number (for companies) must also be specified in the 1099 Tax Form.

Additional information about independent contractors and determination of their status - the IRS Common Law Test to differentiate between an employee and an independent contractor - is discussed in detail in Tutorial 2. |

|

|

26. OUTSIDE PAYROLL ACCOUNTING SERVICES |

|

|

OUTSIDE PAYROLL ACCOUNTING SERVICES |

Many owners of small and medium-sized companies often prefer to use Outside Payroll Accounting Services instead of having the “headache” of handling payroll accounting inside their organizations. Such services are provided virtually in every state in the U.S. and many of them proved to be very timely, accurate, and cost-effective. For this reason you are also encouraged to investigate the availability of suitable payroll accounting services in your area.

Additional information about payroll accounting services may be found online: |

|

|

|

27. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

28. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

You Really Get What You Pay For!

|

Go To The Next Open Check Point In This Promotion Program Online. |

| |

|