FINANCIAL MANAGEMENT

CHECK POINT 60: INTEGRATED FINANCIAL MANAGEMENT

This Check Point Is Available By Subscription Only,

But You Can Still Check Out The Menu Below. |

| 1. |

Advantages Of Computerized Systems |

| 2. |

Types And Costs Of Computerized Systems |

| 3. |

Elements Of Computerized Systems |

| 4. |

Computer Software Packages |

| 5. |

Application Of Computerized Systems In Accounting |

| 6. |

Steps In The Integrated Financial Management Process |

| 7. |

Implement And Maintain A Suitable Accounting Software Package |

| 8. |

Prepare Most Recent Financial Statements |

| 9. |

Conduct Financial Performance Evaluation |

| 10. |

Develop, Implement, And Maintain A Financial Planning System |

| 11. |

Formulate Tax Strategies |

| 12. |

Identify And Arrange Sources Of Capital |

| 13. |

Develop, Implement, And Maintain Internal Control Systems |

| 14. |

Develop, Implement, And Maintain A Payroll Accounting System |

| 15. |

Develop, Implement, And Maintain A Cost Accounting System |

| 16. |

Develop, Implement, And Maintain A Management Accounting System |

| 17. |

Maintain An Integrated Financial Management System |

| 18. |

For Serious Business Owners Only |

| 19. |

The Latest Information Online |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

FINANCIAL MANAGEMENT

CHECK POINT 60: INTEGRATED FINANCIAL MANAGEMENT

Please Select Any Topic In Check Point 60 Below And Click. |

| 1. |

Advantages Of Computerized Systems |

| 2. |

Types And Costs Of Computerized Systems |

| 3. |

Elements Of Computerized Systems |

| 4. |

Computer Software Packages |

| 5. |

Application Of Computerized Systems In Accounting |

| 6. |

Steps In The Integrated Financial Management Process |

| 7. |

Implement And Maintain A Suitable Accounting Software Package |

| 8. |

Prepare Most Recent Financial Statements |

| 9. |

Conduct Financial Performance Evaluation |

| 10. |

Develop, Implement, And Maintain A Financial Planning System |

| 11. |

Formulate Tax Strategies |

| 12. |

Identify And Arrange Sources Of Capital |

| 13. |

Develop, Implement, And Maintain Internal Control Systems |

| 14. |

Develop, Implement, And Maintain A Payroll Accounting System |

| 15. |

Develop, Implement, And Maintain A Cost Accounting System |

| 16. |

Develop, Implement, And Maintain A Management Accounting System |

| 17. |

Maintain An Integrated Financial Management System |

| 18. |

For Serious Business Owners Only |

| 19. |

The Latest Information Online |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 60 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 60? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about Integrated Financial Management and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• About the advantages of computerized systems.

• About types and costs of computerized systems.

• About various elements of computerized systems.

• About computer software packages.

• About application of computerized systems in accounting.

• About steps in the integrated financial management process.

• About implementing and maintaining a suitable software accounting package.

• About preparing most recent financial statements.

• About conducting financial performance evaluation.

• About developing, implementing, and maintaining a financial planning system... and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 60 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. ADVANTAGES OF COMPUTERIZED SYSTEMS |

|

|

COMPUTERIZED SYSTEMS |

Business owners and financial managers must be fully informed about the most updated computerized systems and should implement these systems within their organizations to succeed in the competitive business environment.

The majority of small business owners currently use or plan to use a Computerized System to speed up a broad range of management procedures within their organization. Technological progress in the area of Micro-Computers and Mini-Computers and attractive prices further enhance the usefulness of computerized systems. These systems offer several important advantages outlined below. |

ADVANTAGES OF COMPUTERIZED SYSTEMS |

1. |

Accurate and fast computation of repetitive accounting tasks. |

2. |

Storage of large amounts of accounting information. |

3. |

Easy access to accounting information for evaluation and processing purposes. |

4. |

Effective transfer of information to other computerized systems. |

5. |

Possible reduction of administrative staff. |

6. |

Enhanced level of service to customers and their subsequent satisfaction. |

7. |

Additional long-term savings in the administration costs. |

8. |

Fast access to valuable information on the Internet. |

|

| |

PERSONAL COMPUTERS |

|

There are a variety of Personal Computers and systems in the marketplace that may be suitable for small and medium-sized organizations. It is essential, therefore, to identify specific computerization requirements and to establish the scope of investment into a suitable computerized system.

The preliminary evaluation of Computerization Needs entails establishing high priority areas in accordance with overall business objectives and setting appropriate cost parameters outlined below.

|

PRELIMINARY EVALUATION OF COMPUTERIZATION NEEDS |

1. |

The specific reasons for computerization. |

2. |

The specific objectives and the anticipated benefits as a result of computerization. |

3. |

The cost justification for a computerized system. |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

2. TYPES AND COSTS OF COMPUTERIZED SYSTEMS |

|

|

INTRODUCTION OF COMPUTERIZED SYSTEMS IN A COMPANY |

Computers are frequently used in a variety of accounting procedures, such as preparing salaries and wages, printing job estimates and sales invoices, recording data into the general ledger, and maintaining inventory control records. It is suggested, however to maintain all existing procedures within the accounting department until a reliable and fully tested computerized system is functioning properly.

Introduction Of Computerized Systems usually requires additional training of existing employees, engagement of new employees, and redesign of certain accounting procedures and forms. Thus, the computerization process could present certain challenges during its integration with other operational activities.

There are several types of Computerized Systems available to small and medium-sized organizations outlined below.

|

TYPES OF COMPUTERIZED SYSTEMS |

1. |

Personal Computer.

This system includes a single terminal, hard disk storage, CD-ROM drive, monitor, and a printer. A personal computer can be used independently or as a terminal to a larger computer network. |

2. |

Multi-Work Station System.

This system includes a number of interconnected terminals, which represent a computerized network. Such a network includes several monitors, printers, and storage devices. |

3. |

Computer Service Bureau.

This system does not require computer installation within a company. It merely provides access to an outside computer network either by means of manually generated forms or by means of a terminal or a telephone link-up. |

|

| |

COST OF A COMPUTERIZED SYSTEM |

Many entrepreneurs and small business owners became very familiar with Personal Computers during the last twenty years. A large variety of software programs for a broad range of business applications provides additional stimulation for the use of computers in a business environment. Moreover, services offered by numerous computer service bureaus in such areas as payroll accounting and tax preparation also became very popular among small business owners.

At present, the majority of small business owners use a computer in their business for one purpose or another, depending upon their specific needs. Many business owners are also considering possible purchase and installation of more powerful computers or, alternatively, of Multi-Work Stations for their businesses. The cost of personal computers and multi-work stations has fallen dramatically during recent years, and their average price varies between $500 and $3,000.

Regardless of size, there are three major components in any Computerized System illustrated below. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

3. ELEMENTS OF COMPUTERIZED SYSTEMS |

|

|

COMPUTERIZED SYSTEM COMPONENTS |

|

|

|

|

|

Computer

Hardware |

|

Computer

Software |

|

Computer

Operators |

This consists of input devices, a Central Processing Unit (CPU), and output devices. |

|

This consists of a number of software programs, which enable the computerized system to become operationally functional. |

|

This includes company employees who are trained to add the human element to the computerized system. |

| |

|

Computer system Input Devices enable entry of the initial information into the computerized system through several types of system elements illustrated below. |

COMPUTER SYSTEM INPUT DEVICES |

|

|

|

|

|

Keyboard

Terminal

And

A Mouse |

Optical

Scanners |

Bar

Code

Readers |

Voice

Input

Devices |

Digital

Cameras |

|

|

A CENTRAL PROCESSING UNIT (CPU) |

A Central Processing Unit (CPU) is the brain of the computerized system. Once the data is entered into the system, it is directed to the CPU.

The CPU consists of several elements outlined below. |

ELEMENTS OF THE CENTRAL PROCESSING UNIT (CPU) |

1. |

A Control Unit.

The prime function of the control unit is to interpret instructions from a particular computer program or software package. |

2. |

An Arithmetic-Logic Unit.

The arithmetic-logic unit is designed to execute various instructions prescribed by the computer program and to perform appropriate calculations. |

3. |

Memory Section.

The prime function of the memory section in the CPU is to store data. The memory section has two distinctive elements of data storage:

• Read Only Memory (ROM).

This section is designed to store programs built into the computer by the manufacturer.

• Random Access Memory (RAM).

This section is designed to enable the computer to receive information through input media and store it efficiently. |

|

Note: A computer's memory is measured in Kilobytes, Megabytes, Gigabytes, or Terabytes. |

NOTE: |

• One Kilobyte of memory has the capacity to store 1,024 characters.

• One Megabyte = 1,000 Kilobytes of memory.

• One Gigabyte = 1,000 Megabytes = 1,000,000 Kilobytes of memory.

• One Terabyte = 1,000 Gigabytes = 1,000,000 Megabytes = 1,000,000,000 characters of memory. |

THE PURPOSE OF THE COMPUTER SYSTEM OUTPUT DEVICES |

Computer System Output Devices are designed to provide temporary or permanent storage of data and display of requested information to computer operators, or other computers. The output devices consist of several elements outlined below. |

COMPUTER SYSTEM OUTPUT DEVICES |

1. |

CD-ROMs

CD-ROM is a very handy device, which can be easily inserted into the computer within a minute. The CD-ROM must be handled with utmost care since it is a very delicate device. The main advantage of a CD-ROM is that it contains 650 Megabytes in memory and more. One CD-ROM can easily accommodate the complete set of Encyclopedia Britannica. |

2. |

Monitors.

Monitors are designed to provide a visual presentation of the information fed and contained within the computer system. |

3. |

Speakers.

Speakers are designed to provide sound presentation of the information fed and contained within the computer system. |

4. |

Printers.

Printers are designed to provide a printout of specific information upon the command of the computer operator. |

|

| |

A COMPUTER OPERATOR |

A Computer Operator represents one of the most critical elements of any computerized system. The prime functions of a computer operator are to activate and to operate the computerized system continuously as outlined below. |

MAIN FUNCTIONS OF A COMPUTER OPERATOR |

1. |

Feeding the input data into the system. |

2. |

Monitoring the computer's performance. |

3. |

Collecting results and preparing reports. |

|

| |

EFFECTIVENESS OF THE COMPUTERIZED SYSTEM |

Since the computer is only an electronic machine, the human factor plays a highly significant role in its performance. A computerized system, therefore, is only as effective as the human link involved in its operation. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

4.COMPUTER SOFTWARE PACKAGES |

|

|

A COMPUTER SOFTWARE |

The Computer Software is a special program that is comprised of a set of instructions for the computer to perform routine procedures. There are various computer software packages in the marketplace designed to serve the needs of small and medium-sized companies. These packages are available in several areas outlined below. |

GENERAL APPLICATION OF COMPUTER SOFTWARE PACKAGES |

1. |

Accounting information system (AIS). |

2. |

Business process mapping. |

3. |

Business process modelling. |

4. |

Calculating financial ratios. |

5. |

Computer-aided design and manufacturing (CAD-CAM). |

6. |

Computer integrated manufacturing (CIM) |

7. |

Cost accounting. |

8. |

Customer relationship management (CRM). |

9. |

E-mail marketing. |

10. |

Employee performance appraisal. |

11. |

Enterprise collaboration systems (ECS). |

12. |

Enterprise resource planning (ERP). |

13. |

Executive information system (EIS). |

14. |

Financial planning and control. |

15. |

General business planning. |

16. |

General accounting. |

17. |

Human resources planning and control. |

18. |

Information technology (IT). |

19. |

Inventory and capital assets management. |

20. |

Lean management systems. |

21. |

Management accounting. |

22. |

Manufacturing resource planning (MRPII). |

23. |

Marketing and sales planning and control. |

24. |

Materials requirements planning (MRP). |

25. |

Payroll accounting. |

26. |

Partner relationship management (PRM). |

27. |

Product design and computer-aided design (CAD). |

28. |

Production and operations planning and control. |

29. |

Program evaluation and review (CPM)/PERT |

30. |

Project estimating and planning. |

31. |

Project management. |

32. |

Search engine optimization (SEO). |

33. |

Social media marketing. |

34. |

Supply chain management. |

|

The price of these packages may vary between $50 and $5,000 or more, depending upon their functional design and the degree of sophistication. The cost of some ERP systems may run into tens and even hundreds of thousands of Dollars, depending upon the specific system. |

ADDITIONAL INFORMATION ONLINE |

You can obtain additional information about various accounting software packages online. |

|

|

|

5. APPLICATION OF COMPUTERIZED SYSTEMS IN ACCOUNTING |

|

|

IMPORTANCE OF COMPUTERIZED ACCOUNTING SYSTEMS |

Correct selection of a Computerized Accounting System may provide several important advantages and may substantially improve the overall work efficiency in the financial department and in the company as a whole.

The majority of all small and medium-sized companies are using various types of Accounting Software Programs for several purposes outlined below. |

SPECIFIC APPLICATION OF COMPUTERIZED SYSTEMS |

1. |

Journalizing accounts and posting accounts into the ledger. |

2. |

Preparing trial balances. |

3. |

Producing financial statements. |

4. |

Preparing monthly debtors and creditors age analysis reports. |

5. |

Preparing monthly management reports. |

6. |

Preparing inventory status reports. |

7. |

Maintaining capital assets status reports. |

8. |

Printing estimates, invoices, and statements. |

9. |

Maintaining a payroll accounting system. |

10. |

Managing operations planning and MRP systems. |

11. |

Managing sales force planning and control. |

12. |

Maintaining employee records. |

13. |

Preparing project planning, costing, and control reports. |

|

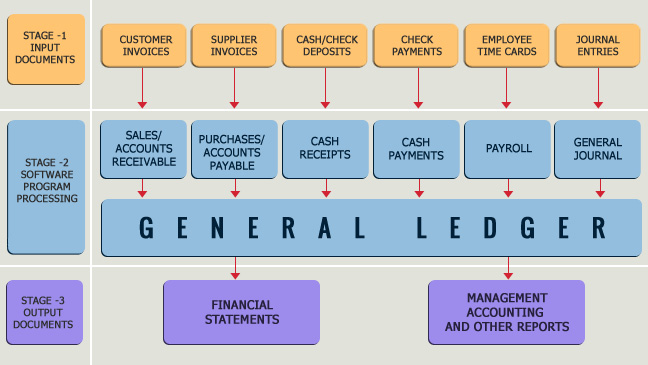

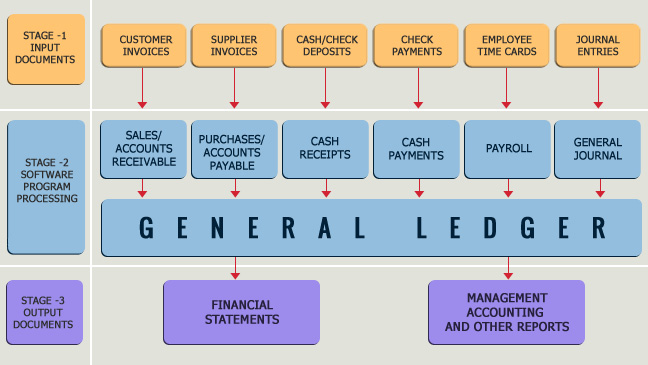

A typical illustration of a Computerized Accounting System using a General Ledger Software is presented below. |

MICROPROCESSOR ACCOUNTING SYSTEM

USING GENERAL LEDGER SOFTWARE |

|

| |

ELEMENTS OF A SUCCESSFUL COMPUTERIZATION PROCESS |

The process of switching to a new computerized system requires additional investment in the computer hardware, software, and training of operators. The final decision in introducing a new Computerized Accounting System, therefore, is based on the economic viability of the entire process.

Business owners and managers need to remember that when a new computerized accounting system is installed within the company, the existing system must remain operative until the new system becomes completely reliable.

The switching process can be a lengthy one and may take several months before the new system is fully operational. Any computerized system is only as effective as the people who operate it. Thus, if Computer Operators are not sufficiently trained, unsuitable software packages are used, or both, the result may be very disappointing.

Hence, in order to succeed in installing a new system, it is vitally important to have three essential components outlined below. |

THREE ESSENTIAL COMPONENTS OF A COMPUTERIZED ACCOUNTING SYSTEM |

1. |

Reliable hardware. |

2. |

Suitable software. |

3. |

Skilled and reliable computer operators. |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

6. STEPS IN THE INTEGRATED FINANCIAL MANAGEMENT PROCESS |

|

|

INTEGTRATED FINANCIAL MANAGEMENT |

|

Once a new computerized accounting system is properly installed in your organization, you and your management team can begin the process of Integrated Financial Management.

The Integrated Financial Management Process entails implementation and coordination of various steps in the areas of finance and accounting within your organization. The implementation of this process is the responsibility of the Vice President, Finance, or the Financial Manager in the accounting department.

A typical integrated financial management process entails a number of steps illustrated below.

|

STEPS IN THE INTEGTRATED FINANCIAL MANAGEMENT PROCESS |

Step 1: Implement And Maintain A Suitable Accounting Software Package.

Step 2: Prepare Most Recent Financial Statements.

|

|

Step 3: Conduct Financial Performance Evaluation.

|

|

|

|

|

|

Current

Financial Analysis |

|

Comparative

Financial Analysis |

|

Financial

Ratio Analysis |

|

|

|

|

Step 4: Develop, Implement, And Maintain A Financial Planning Or Budgeting System.

|

|

|

Step 5: Formulate Tax Strategies.

Step 6: Identify And Arrange Sources Of Capital.

Step 7: Develop, Implement, And Maintain Internal Control Systems.

|

|

|

Step 8: Develop, Implement, And Maintain A Payroll Accounting System.

Step 9: Develop, Implement, And Maintain A Cost Accounting System.

Step 10: Develop, Implement, And Maintain A Management Accounting System.

Step 11: Collaborate With Computer Experts In Developing, Implementing, And Maintaining An Integrated Financial Management System.

|

|

|

|

7. IMPLEMENT AND MAINTAIN A SUITABLE ACCOUNTING SOFTWARE PACKAGE |

|

|

ACCOUNTING SOFTWARE PROGRAMS |

There are several Accounting Software Programs, which include a Computerized Bookkeeping System, widely available to small business owners today. The prime purpose of an accounting software program is to enable a company's financial manager or bookkeeper to record all financial transactions continuously in a controlled and systematic manner.

An accounting software program entails setting up accounts, recording and processing all financial transactions, and generating a broad range of financial and management accounting reports in a company. This system is driven by an accounting database software program and offers a time-efficient way of accomplishing operational tasks in the Financial Department. |

MAIN FUNCTIONS OF AN ACCOUNTING SOFTWARE PROGRAM |

1. |

Setting up a chart of accounts for assets, liabilities, income, expenses, and shareholders' equity. |

2. |

Recording and posting each transaction in an appropriate account. |

3. |

Recording and tracking all cash and credit sales to customers. |

4. |

Recording and tracking all cash and credit purchases from suppliers. |

5. |

Recording and tracking all payments received from customers for cash and credit sales. |

6. |

Recording and tracking all payments issued to suppliers for cash and credit purchases. |

7. |

Preparing and printing delivery notes, invoices, and monthly statements to customers. |

8. |

Preparing debtors and creditors monthly and year-to-date age analysis reports. |

9. |

Determining and recording sales tax for relevant business transactions. |

10. |

Recording and tracking checking accounts, banking transactions and balances. |

11. |

Recording and tracking employee time cards. |

12. |

Preparing, recording, and tracking employee payroll, payroll deductions and company payroll contributions. |

13. |

Recording and tracking job costs for various jobs, services and projects. |

14. |

Preparing financial statements, including balance sheets and income statements. |

15. |

Preparing cash flow projections and statements of cash flows. |

16. |

Preparing and printing various charts and graphs related to financial management. |

|

| |

ADVANTAGES OF AN ACCOUNTING SOFTWARE PROGRAM |

A suitable Accounting Software Program with a Computerized Bookkeeping System provides business owners with several important advantages and helps to improve overall operational efficiency in the financial department.

The main advantages of an accounting software program include:

• High level of accuracy in processing financial transactions.

• Speed in completing financial transactions.

Financial transactions relate to the company's customers, suppliers, bank accounts, employee payroll, job costing, inventory, and taxes. The accounting software program also provides business owners and their management teams with important financial statements, management accounting reports, and numerous charts and graphs designed to assist in the business decision-making process. |

POPULAR ACCOUNTING SOFTWARE PROGRAMS |

| There are several excellent Accounting Software Programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

|

• Sage One

• QuickBooks Intuit

• FreshBooks

• Harvest Software Systems

• NetSuite

|

| Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

|

|

8. PREPARE MOST RECENT FINANCIAL STATEMENTS |

|

|

FINANCIAL STATEMENTS |

You and your financial management team must be able to properly "read" and interpret all financial statements, which are of prime importance to every business organization.

Accurate and comprehensive maintenance of the bookkeeping system facilitates timely preparation of Financial Statements. These statements consist of three important documents, illustrated below, which are designed to provide the most updated information regarding three essential parameters of the company's financial status:

• Company's Solvency.

• Company's Profitability.

• Company's Liquidity. |

| |

THREE IMPORTANT FINANCIAL STATEMENTS |

|

|

|

Balance

Sheet |

Income

Statement |

Statement

Of Cash Flows |

A balance sheet provides information about a company's solvency, i.e. the excess of its assets over its liabilities at a specific moment of time. |

Income statement provides information about a company's profitability, i.e. the excess of its revenues over its expenses during a specific period. |

A statement of cash flows provides information about a company's liquidity, i.e. the excess of its available and incoming funds over its outgoing funds during a specific period. |

| |

|

| Financial Statements are discussed in detail in Tutorial 3. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

9. CONDUCT FINANCIAL PERFORMANCE EVALUATION |

|

|

FINANCIAL PERFORMANCE EVALUATION |

You and your financial management team must be familiar with the basic elements of financial performance evaluation, which represents one of the key management functions in every organization.

The timely preparation and availability of financial statements assists top management in the process of examining the condition and performance of a company. This process, known as Financial Performance Evaluation, serves to identify the company's strengths and weaknesses in terms of dollars and percentages.

The financial performance evaluation is designed to provide answers to a broad range of important questions, some of which are outlined below. |

ISSUES RELATED TO THE FINANCIAL PERFORMANCE EVALUATION |

1. |

Does the company have enough cash to meet all its obligations? |

2. |

Does the company generate sufficient volume of sales to justify recent investment? |

3. |

Does the company collect outstanding accounts from customers without creating a burden on its cash flow? |

4. |

Does the company make timely payments to suppliers to take advantage of discounts? |

5. |

Does the company utilize the inventory in an efficient manner? |

6. |

Does the company have sufficient working capital? |

7. |

Does the company maintain an adequate profit margin? |

8. |

Does the company produce sufficient return on investment? |

|

| |

FINANCIAL PERFORMANCE VARIABLES |

All of the above mentioned and other conditions must be met to ensure effective organizational performance and an acceptable level of return on the shareholders' investment.

To determine whether such conditions are met, management must evaluate the company's performance on a regular basis, e.g. once every three, six, or twelve months, and analyze results in terms of three Financial Performance Variables illustrated below. |

THREE FINANCIAL PERFORMANCE VARIABLES |

|

|

|

Predetermined

Standards |

Past

Performance |

Acceptable Norms

Within An Industry |

The company's performance must be measured against its own current financial budgets to determine the progress towards meeting current financial objectives. |

The company's performance must be measured against its past performance to establish the trends developed over the recent business period. |

The company's performance must be measured against the acceptable norms within its industry to determine the level of the company's competitiveness in the marketplace. |

| |

|

| Financial Performance Evaluation is discussed in detail in Tutorial 3. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

10. DEVELOP, IMPLEMENT, AND MAINTAIN A FINANCIAL PLANNING SYSTEM |

|

|

FINANCIAL PLANNING PROCESS |

You and your financial management team must master the art and the science of the budgeting process, which represents a critical part of the integrated financial management process.

The evaluation of financial statements provides management with essential information and assists throughout the Financial Planning Process. The main objective of this process is to prepare a set of plans, or budgets, for the forthcoming fiscal period.

In accounting terms, a Budget is defined as a comprehensive quantitative plan for utilizing the resources of the organization within a specified period of time.

The process of preparing a budget, or the Budgeting Process, is an integral part of the company's operational planning activities. The budgeting process is essential in maintaining an effective control of company activities and it has several important advantages outlined below. |

ADVANTAGES OF THE BUDGETING PROCESS |

1. |

Management ideas can be converted into specific tangible objectives and formal plans. |

2. |

Objectives and plans can be communicated throughout the organization. |

3. |

Strategic and operational plans can be implemented efficiently to achieve organizational objectives. |

4. |

Coordination of operational activities within the organization can be improved. |

5. |

Effective management control is facilitated. |

|

| |

MASTER BUDGET |

The final outcome of the budgeting process is a Master Budget which consists of two major components presented next. All individual elements of a master budget are strongly interrelated and must be prepared in a particular sequence.

The formal relationship between these budgets and the sequence of their preparation is illustrated below. |

ELEMENTS OF A MASTER BUDGET |

|

|

|

| Operating Budget |

|

Financial Budget |

This is a financial plan that provides a description of a company's future operating results. It includes:

• Sales Budget.

• Production Or Operations Budget (Cost Of Sales Budget).

• Operating Expenses Budget.

• Budgeted Income Statement. |

|

This is a financial plan that provides a description of a company's future financial condition. It includes:

• Capital Expenditure Budget.

• Cash Budget (Cash Flow Projection).

• Budgeted Balance Sheet. |

|

|

| Operating Budget is discussed in detail in Tutorial 3. |

| |

ADDITIONAL INFORMATION ONLINE |

Please watch these excellent videos professionally narrated and produced by Susan Crosson and SFCC: |

|

© 2008 - 2013 Susan Crosson and CFCC. All rights reserved. |

|

|

11. FORMULATE TAX STRATEGIES |

|

|

INFLUENCE OF TAX STRATEGIES ON BUSINESS DECISIONS |

You and your financial management team must be familiar with various tax strategies and work closely with an experienced and pro-active CPA to ensure the most cost-effective financial performance of the organization.

Income Taxes are an important factor in the overall financial planning process and they often influence business decisions. Selection of the most effective Tax Strategies represents, therefore, an integral part of the budgeting process and necessitates continuous cooperation between business people and their accountants or CPAs.

Tax strategies depend firstly upon the form of business organization. There are four basic forms of business organization illustrated below. |

FOUR BASIC FORMS OF BUSINESS ORGANIZATION |

|

| |

COMMON TAX REDUCTION STRATEGIES |

| • Selection Of An Experienced And Pro-Active CPA. |

|

| It is extremely important to select a CPA or an accountant who has a pragmatic approach to developing tax reduction plans on a pro-active basis instead of a reactive basis, i.e. who helps to plan tax strategies in advance and not merely prepares tax returns after the events took place. |

|

| • Selection Of The Most Suitable Form Of Business Entity. |

|

| It is extremely important to select the most appropriate form of business organization, namely: sole proprietorship, partnership, C-Corporation, S-Corporation, or LLC to ensure the most cost effective results at the end of each tax year. |

|

| • Selection Of A Tax Year For Ordinary Corporation. |

|

| The Tax Reform Act Of 1986 prescribes that sole proprietorships, partnerships, and S-Corporations adopt the tax year of their principal partners or shareholders. |

|

| • Selection Of A Suitable Accounting Method. |

|

| There are two basic accounting methods for record keeping and income tax calculation: the Cash Method and the Accrual Method. |

|

| • Selection Of The Amortization Method. |

|

| This is for such items as start-up and organizational expenses, research and development costs, and other preliminary expenses. |

|

| • Selection Of A Suitable Inventory-Count Method. |

|

| This includes FIFO, or First-In-First-Out; LIFO or Last-In-First-Out, and other methods. |

|

| • Selection Of A Suitable Method For Depreciating Capital Assets. |

|

| This includes Straight-Line Depreciation, Reducing Balance Depreciation. |

|

| • Selection Of Suitable Compensation Methods. |

|

| This includes salaries, stock options, employee benefits, retirement plans, and insurance plans for shareholders and employees. |

|

| • Selection Of A Suitable Method Of Financing. |

|

| This entails examination of the Debt Financing Method versus the Equity Financing Method. |

|

|

Note:

For additional information please go to Internal Revenue Service online or consult with your accountant or CPA.

|

| Tax Strategies are discussed in detail in Tutorial 3. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

12. IDENTIFY AND ARRANGE SOURCES OF CAPITAL |

|

|

CAPITAL REQUIREMENTS |

You and your financial management team must be fully familiar with various methods and sources of financing to ensure stable and profitable performance of their organization.

One of the major elements of Financial Planning is the search for the additional Capital that may be required by your company during a particular accounting period.

Your company may need additional capital for several reasons, depending on the nature of its activities, stage of development, profitability, and the aspirations of your shareholders. Some of the typical examples of Capital Requirements are outlined below. |

REASONS FOR CAPITAL REQUIREMENTS |

1. |

A new company needs start-up and working capital. |

2. |

An existing company needs additional capital for research and development of new products and services, acquisition of capital assets, or financing of an increased volume of sales. |

3. |

A company needs additional capital to compensate for an anticipated cash shortage during a specific accounting period. |

|

| |

METHODS OF FINANCING |

Once acceptable answers to capital requirement questions have been provided, the search for suitable sources of capital should begin. The first step in this process entails identification of the most viable Method Of Financing. Two commonly used methods of financing are illustrated below. |

TWO MAIN METHODS OF FINANCING |

|

Sources Of Capital are discussed in detail in Tutorial 3. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

13. DEVELOP, IMPLEMENT, AND MAINTAIN INTERNAL CONTROL SYSTEMS |

|

|

INTERNAL CONTROL |

You and your financial management team must be familiar with design, installation, and maintenance of stringent Internal Control systems within the financial department which represents one of the critical management functions in every business organization.

There are two types of internal control illustrated below. |

TWO TYPES OF INTERNAL CONTROL |

|

| |

INTERNAL ACCOUNTING CONTROL |

The main purpose of Internal Accounting Control is to ensure the completeness, accuracy, validity, and maintenance of accounting records and physical security of assets. All basic internal accounting control procedures must be performed in accordance with the Generally Accepted Accounting Principles (GAAP).

Some of the basic requirements of internal accounting control are outlined below. (7). |

BASIC REQUIREMENTS OF INTERNAL ACCOUNTING CONTROL |

1. |

Transactions are executed in accordance with management's general or specific authorization. |

2. |

Access to assets is permitted only in accordance with management's authorization. |

3. |

Transactions are recorded as necessary to permit preparation of financial statements in conformity with Generally Accepted Accounting Principles (GAAP) and to maintain accountability for assets. |

4. |

The recorded accountability for assets is compared with existing assets at reasonable intervals and appropriate action is taken with respect to any differences. |

|

© American Institute of Certified Public Accountants, Professional Standards, Vol. 1 |

INTERNAL ADMINISTRATIVE CONTROL |

The main purpose of Internal Administrative Control is to ensure high operational efficiency within the financial department and adherence to managerial policies related to the accounting function. Main tasks of internal administrative control are outlined below. |

INTERNAL ADMINISTRATIVE CONTROL TASKS |

1. |

Dealing with the company's customers, suppliers, and creditors. |

2. |

Authorizing business transactions pertaining to the purchase and sale of products or services. |

3. |

Maintaining a proper bookkeeping system. |

4. |

Maintaining steady control over company assets such as cash, inventory, and capital assets. |

5. |

Maintaining an updated payroll accounting system. |

6. |

Collecting cost accounting information. |

7. |

Preparing management accounting reports. |

8. |

Maintaining a computerized accounting system. |

|

| |

ELEMENTS OF INTERNAL CONTROL |

Detailed information about various elements of internal control is provided in Tutorial 3: |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

14. DEVELOP, IMPLEMENT, AND MAINTAIN A PAYROLL ACCOUNTING SYSTEM |

|

|

PAYROLL ACCOUNTING SYSTEM |

You and your financial management team must be fully familiar with the development, implementation, and maintenance of an effective payroll accounting system, which is one of the prime managerial responsibilities in every company.

One of the major operating expenses incurred by most companies relates to Salaries, Wages, and Commissions paid and benefits provided to employees. In fact, in many labor-intensive manufacturing and service industries, the Payroll Cost represents the largest operating expense.

Hence, one of the important tasks of financial management is development, implementation, and maintenance of an effective Payroll Accounting System. An ordinary payroll accounting system is associated with three general types of liabilities illustrated below.(17) |

ELEMENTS OF A PAYROLL ACCOUNTING SYSTEM |

|

Liabilities For Employee Compensation include three types of payments by the company to its employees illustrated below. Each type is discussed in details next. |

LIABILITIES FOR EMPLOYEE COMPENSATION |

|

| |

LIABILITIES FOR EMPLOYEE PAYROLL WITHHOLDINGS |

Liabilities For Employee Payroll Withholdings represent a second major element of an ordinary payroll accounting system. These liabilities include all deductions that must be withheld by law from employees' earnings and sent directly to the appropriate government agencies. This group of liabilities includes three types illustrated below. |

THREE TYPES OF LIABILITIES FOR EMPLOYEE PAYROLL WITHHOLDINGS |

|

Additional Withholdings made from employees' earnings relate to various benefit programs designed for employees. These withholdings may include the following types, as illustrated below. |

ADDITIONAL WITHHOLDINGS MADE FROM EMPLOYEES' EARNINGS |

|

|

|

|

|

|

|

|

Retirement

Payments |

|

Medical

Insurance

Premiums |

|

Life

Insurance

Premiums |

|

Union

Dues |

|

Charitable

Contributions |

|

|

| |

LIABILITIES FOR EMPLOYER PAYROLL TAXES |

Liabilities For Employer Payroll Taxes represent the final element of an ordinary payroll accounting system. These liabilities include all contributions that, by law, must be paid by the employer and sent directly to the appropriate government agencies. This group of liabilities includes three types illustrated below. |

THREE TYPES OF LIABILITIES FOR EMPLOYER PAYROLL TAXES |

|

Payroll Accounting is discussed in detail in Tutorial 3. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

15. DEVELOP, IMPLEMENT, AND MAINTAIN A COST ACCOUNTING SYSTEM |

|

|

THE PURPOSE OF COST ACCOUNTING |

You and your financial management team must be able to develop, implement, and maintain an effective cost accounting system, which represents one of the most critical financial responsibilities in every business organization.

The main purpose of the Cost Accounting System is to facilitate practical methods of identifying and measuring costs of goods and services supplied by the company.

Cost Accounting deals with four important tasks illustrated below. |

FOUR IMPORTANT TASKS OF COST ACCOUNTING |

|

|

|

|

|

|

|

Classification

Of

Costs |

|

Development

Of A Costing

System |

|

Determination

Of Cost

Recovery Rates |

|

Implementation

Of The Costing

System |

|

|

All costs incurred by a company during a process of supplying goods and services to customers are classified into Two Basic Categories illustrated below. |

TWO BASIC CATEGORIES OF COSTS |

|

Both, direct and indirect costs differ, depending upon the nature of the company's activities, namely: service, merchandising, or manufacturing. |

DETAILED CLASSIFICATION OF COSTS |

|

|

|

| Direct Costs |

|

Indirect Costs |

All operating expenses that can be physically traced to a particular product or service supplied by a company.

|

|

All operating expenses that cannot be physically traced to a particular product or service supplied by a company |

|

|

|

|

|

| Service Company |

|

Service Company |

Direct Service Cost, i.e. salaries and wages of employees whose time is charged to customers; cost of materials supplied to customers.

|

|

Indirect Service Cost, or Service Overhead, i.e. all administrative, general, and selling expenses. |

|

|

|

|

| Merchandising Company |

|

Merchandising Company |

Direct Merchandising Cost, i.e. cost of merchandise purchased for resale to customers.

|

|

Indirect Merchandising Cost, or Merchandising Overhead, i.e. all administrative, general, and selling expenses. |

|

|

|

|

| Manufacturing Company |

|

Manufacturing Company |

Direct Manufacturing Cost:

• Direct material cost.

• Direct labor cost.

• Direct sub-contracting service cost.

|

|

Indirect Manufacturing Cost, or Manufacturing Overhead:

• Plant overhead.

• All administrative, general, and selling costs. |

|

|

Cost Accounting is discussed in detail in Tutorial 3. |

ADDITIONAL INFORMATION ONLINE |

Please watch these excellent videos professionally narrated and produced by Susan Crosson and SFCC: |

|

© 2008 - 2013 Susan Crosson and CFCC. All rights reserved. |

|

|

16. DEVELOP, IMPLEMENT, AND MAINTAIN A MANAGEMENT ACCOUNTING SYSTEM |

|

|

MANAGEMENT ACCOUNTING INFORMATION |

You and your financial management team must be able to develop, understand, and implement accurate and timely accounting information for planning, decision-making, pricing, and controlling activities within every business organization.

This information, known as Management Accounting Information, must be prepared in the financial department on a regular basis. In order to provide an effective method of handling such an important task, the company must develop, implement, and maintain a comprehensive Management Accounting System. |

CRITERIA FOR MANAGEMENT ACCOUNTING REPORTS |

The main feature of Management Accounting Reports is their usefulness for day-to-day management control. Hence, the format of these reports may vary from one company to another, depending upon the size, type, and particular requirements of the organization.

Most management accounting reports must be prepared on a regular basis to facilitate comprehensive evaluation of the company's performance.

Effective operational guidelines for a Company's Performance Evaluation include several important principles, as outlined below. |

OPERATIONAL GUIDELINES FOR EVALUATING

A COMPANY'S OPERATIONAL PERFORMANCE |

1. |

Provision of accurate and suitable measures of performance through a budgeting procedure. |

2. |

Identification of individual managerial responsibilities based on relevant budget projections. |

3. |

Comparison of actual performance results with the corresponding budget projections. |

4. |

Preparation of performance reports, which include the variance between the planned and actual results. |

5. |

Analysis of performance results and identification of possible causes for variances and areas of concern. |

|

| |

COMPARISON BETWEEN ACTUAL AND BUDGETED VALUES |

An isolated assessment of actual operating results usually does not provide management with the opportunity to judge the performance of the company objectively. For this reason, actual levels of Revenues, Expenses, and Income must be compared with the corresponding budget projections. Such projections constitute an integral part of the budgeting process and should be formulated prior to the commencement of a particular fiscal period.

This process of comparing actual and budgeted values of revenues, expenses and income represents an essential element of the management control function discussed in detail in Tutorial 1. This process is based on the Feedback Control, and it is designed to help management to evaluate the actual results in light of what was planned in the beginning of a particular fiscal period, and to determine Variances.

Management Accounting is discussed in detail in Tutorial 3. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

17. MAINTAIN AN INTEGRATED FINANCIAL MANAGEMENT SYSTEM |

|

|

WHAT MUST YOU AND YOUR FINANCIAL MANAGER DO NEXT? |

Hopefully, at this stage you and your financial manager are familiar with various elements of the Integrated Financial Management and appreciate the critical importance of each element described above. Now you should be ready to complete each individual task and integrate all financial information and results by means of a suitable accounting software package into a simple and practical format.

Since integrated financial management represents a chain of activities, it is essential to ensure that each element of this chain is properly implemented within your financial department. Always remember that "every chain is a strong as its weakest link". Subsequently, if you skip any of the elements in the integrated financial management process, it may cause unnecessary problems in the future. |

CRITICAL IMPORTANCE OF EACH ELEMENT

IN THE INTEGRATED FINANCIAL MANAGEMENT PROCESS |

1. |

Implementing And Maintaining A Suitable Accounting Software Package.

A suitable accounting software package will enable you and your financial management team to implement a broad range of integrated financial management activities in a timely and cost-effective manner. |

2. |

Preparing Most Recent Financial Statements.

Preparation of most recent financial statements will enable you and your financial management team to get the most updated information regarding your company's assets, liabilities, income, expenses, and cash flow. |

3. |

Conducting Financial Performance Evaluation.

Conducting financial performance evaluation will enable you and your financial management team to get the most updated information regarding your company's operational performance, solvency, profitability, and liquidity. |

4. |

Developing, Implementing, And Maintaining A Financial Planning System.

Developing, implementing, and maintaining a financial planning system will enable you and your financial management team to prepare meaningful master budget, sales budget, production or operations budget, operating expense budget, budgeted income statement, capital expenditure budget, and cash budget (cash flow projection). |

5. |

Formulating Tax Strategies.

Formulating tax strategies will enable you and your financial management team to plan your estimated tax liabilities well in advance. This in turn, will provide you with guidance regarding your company's spending behavior, such as purchase of capital equipment, which may decrease your company's profitability, and subsequently reduce estimated tax liability. |

6. |

Identifying And Arranging Sources Of Capital.

Identifying and arranging sources of capital will enable you and your financial management team to properly plan the availability of working capital to support your company's operational performance. This will also help ensuring a healthy cash flow and avoiding the necessity of borrowing money at high interest rates. |

7. |

Developing, Implementing, And Maintaining Internal Control Systems.

Developing, implementing, and maintaining internal control systems will enable you and your financial management team to secure effective cash management and control, control of purchases and disbursements, credit control, inventory management, and capital assets management. |

8. |

Developing, Implementing, And Maintaining A Payroll Accounting System.

Developing, implementing, and maintaining a payroll accounting system will enable you and your financial management team to ensure effective management of three elements of this system, namely: liabilities for employee compensation, liabilities for employee payroll withholdings, and liabilities for employer payroll taxes. |

9. |

Developing, Implementing, And Maintaining A Cost Accounting System.

Developing, implementing, and maintaining a cost accounting system will enable you and your financial management team to ensure effective identification and classification of all costs associated with your operational business activities. This includes all direct and indirect costs which may have been incurred by your organization during a specified period of time. Ultimately, this will enable you to establish accurate overhead cost recovery rates for your products and services, and provide positive input toward implementing competitive pricing strategies. |

10. |

Developing, Implementing, And Maintaining A Management Accounting System.

Developing, implementing, and maintaining a management accounting system will enable you and your financial management team to receive meaningful management accounting reports. These reports will provide you and your team with invaluable insight regarding your company's operational performance versus budgeted values, based on monthly and year-to-date results. Ultimately, these reports will provide you with a monthly and year-to-date variance which will enable you to steer your company toward financial success. |

|

|

|

18. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

19. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

To Err Is Human, But To Really Screw Up You Need A Computer!

Joe Griffith

|

Go To The Next Open Check Point In This Promotion Program Online. |

| |

|