|

FINANCIAL MANAGEMENT

CHECK POINT 44: FINANCIAL STATEMENTS

Please Select Any Topic In Check Point 44 Below And Click. |

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 44 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 44? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about Financial Statements and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• About three important financial statements.

• About three most popular accounting software programs?

• What is a balance sheet?

• About classification of assets, liabilities, and shareholders' equity.

• About an accounting period

• What are the three forms of an income statement?

• About operating revenues and expenses.

• About classification of inventory for accounting purposes.

• What is a statement of cost of goods manufactured?

• What is a cash flow statement... and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 44 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. THREE IMPORTANT FINANCIAL STATEMENTS |

|

|

INTRODUCTION TO FINANCIAL STATEMENTS |

Business owners and financial managers must be able to properly “read” and interpret all financial statements, which are of prime importance to every business organization.

Accurate and comprehensive maintenance of the bookkeeping system facilitates timely preparation of Financial Statements. These statements consist of three important documents, illustrated below, which are designed to provide the most updated information regarding three essential parameters of the company's financial status:

|

THREE IMPORTANT FINANCIAL STATEMENTS |

|

|

|

|

|

Balance

Sheet |

|

Income

Statement |

|

Statement

Of Cash Flows |

| A balance sheet provides information about a company's solvency, i.e. the excess of its assets over its liabilities at a specific moment of time. |

|

Income statement provides information about a company's profitability, i.e. the excess of its revenues over its expenses during a specific period. |

|

A statement of cash flows provides information about a company's liquidity, i.e. the excess of its available and incoming funds over its outgoing funds during a specific period. |

|

| |

| |

| Financial statements are usually prepared by using a specific accounting software program. |

| |

POPULAR ACCOUNTING SOFTWARE PROGRAMS |

There are several excellent accounting software programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

|

| |

Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

|

|

|

2. BALANCE SHEET |

|

|

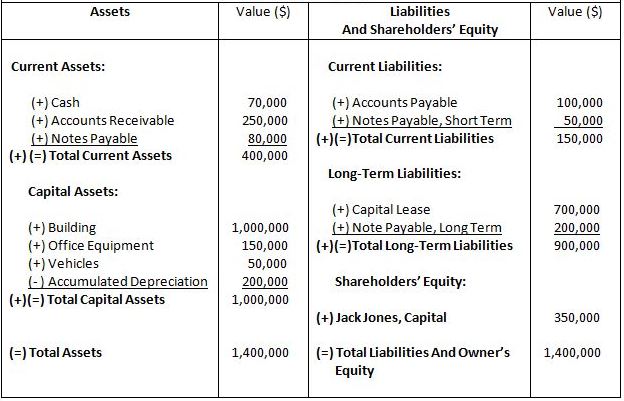

BALANCE SHEET |

A Balance Sheet is a statement of the company's financial position at a specific moment in time.

A balance sheet is referred to as a "snapshot" of the organization's resources and obligations and is intended to describe the financial condition of the company on the date of closing books of account.

The resources, or Assets, available to management are classified into four categories. The obligations, or claims, against these assets are made by creditors and shareholders and are classified as the company's Liabilities and Shareholders' Equity also known as Stockholders' Equity.

A balance sheet merely summarizes the financial position and provides details of all assets and liabilities of the organization at a given date. It does not indicate whether the company makes profit or incurs losses.

The structure of a balance sheet does not depend upon the type of operations, i.e. service, merchandising, or manufacturing companies may have similarly structured balance sheet statements.

A simplified illustration of a typical balance sheet is presented below.

|

CLASSIFICATION OF ASSETS |

1. |

Current Assets.

Current assets include cash, accounts receivable, inventory (merchandise, direct materials, work-in-process, and finished goods), receivables, prepaid expenses, refundable deposits, and short-term investments. |

2. |

Capital Assets.

Capital assets, also known as Fixed Assets or Long-Term Assets, include land, buildings, equipment, furniture, and vehicles purchased for use. |

3. |

Long-Term Investments.

Long-term investments include land, buildings, or equipment purchased for speculative reasons. |

4. |

Intangible Assets.

Intangible assets include patents, copyrights, trademarks, and goodwill. |

|

| |

CLASSIFICATION OF LIABILITIES AND SHAREHOLDERS' EQUITY |

1. |

Current Liabilities.

Current liabilities include accounts payable, bank overdraft (used-up credit line), current portion of a long-term debt, dividends payable, notes payable, payroll liability, taxes payable, product warranty liability, and other accrued liabilities. |

2. |

Long-Term Liabilities.

Long-term liabilities include bonds payable, capital leases, mortgages payable, and pension liability. |

3. |

Shareholders' Equity.

Shareholders' equity includes the value of the issued stock and retained earnings. |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

|

3. ACCOUNTING PERIOD |

|

|

ACCOUNTING PERIOD |

While a Balance Sheet is prepared to reflect a company’s financial condition on a particular date, an Income Statement and a Statement Of Cash Flows are prepared to cover a particular period of the company's operating activities. This period is termed the Accounting Period and represents an important milestone in the company's life.

The length of the accounting period is commonly accepted as one full year, known as the Fiscal Year or Financial Year.

Management has the option of selecting the beginning of the company's fiscal year in accordance with the particular operating conditions and other relevant factors.

Sometimes, financial statements may be drawn up on semi-annually, quarterly or monthly basis, depending upon the specific requirements of the shareholders, management and outside creditors. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

|

4. SMALL BUSINESS EXAMPLE

BALANCE SHEET |

|

|

|

BALANCE SHEET |

Balance Sheet

For ABC Service Company, Inc.

Date: December 31, 2013

|

|

|

|

|

5. INCOME STATEMENT |

|

|

INCOME STATEMENT

An Income Statement summarizes the amounts of operating revenues earned and operating expenses incurred during a specific accounting period.

Income statements, also known as the Profit And Loss Account or P & L Account, should be prepared on a monthly basis to provide management with an essential financial tool designed to measure and control the company’s operational performance. The statement summarizing twelve months of the company's operational performance is termed the Annual Income Statement, or simply the Income Statement, and it represents the second important financial statement.

The prime result of an income statement is the determination of Gross Margin From Sales (for merchandising and manufacturing companies) and Net Income for all types of companies, i.e. Net Profit (before and after taxes).

The final presentation form of revenues, expenses, and net income depends upon the nature of the company's operating activities. This is reflected in three different forms of income statement illustrated below.

THREE FORMS OF AN INCOME STATEMENT |

|

|

|

|

|

Income Statement

For

A Service

Company |

|

Income Statement

For

A Merchandising

Company |

|

Statement

Of Cost

Of Goods

Manufactured |

| |

|

|

|

|

| |

|

|

|

Income Statement

For

A Manufacturing

Company |

|

| |

| |

OPERATING REVENUES AND EXPENSES |

Operating Revenues include all amounts earned by the company as a result of rendering services or selling goods to customers during a specified accounting period, while Operating Expenses include all costs incurred by the company during the same period. Operating expenses for manufacturing companies are also known as Manufacturing Costs, or Factory Overhead, or Factory Burden.

Simplified examples of typical income statements for a service, merchandising and manufacturing companies are presented below. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

6. CLASSIFICATION OF INVENTORY FOR ACCOUNTING PURPOSES |

|

|

INVENTORY VALUES

Service Companies generally don’t have to carry special types of inventory, except for consumable products and some spare parts, to conduct their business operations. For this reason, the income statement for a service company doesn’t take into account the fluctuation of inventory during a specific fiscal period. An exception would be a service business, like a car repair shop, which may have to carry various types of spare parts in large quantities. In this case the fluctuation in inventory must be accounted for to ensure accurate determination of profit and loss during a specific period.

On the other hand, Merchandising Companies, i.e. Wholesalers and Retailers, and Manufacturing Companies must carry substantial amounts of inventory to enable them to conduct their business activities. For this reason, the income statements for merchandising and manufacturing companies must contain detailed information pertaining to the Value Of Inventory carried by the organization during a particular accounting period.

The Classification Of Inventory also depends upon the nature of the company's activities illustrated below.

CLASSIFICATION OF INVENTORY |

|

|

|

|

|

Service

Company |

|

Merchandising

Company |

|

Manufacturing

Company |

|

A service company usually does not carry inventory except for certain consumable items, e.g. supplies, or spare parts.

| • |

Spare Parts |

| • |

Consumable Supplies |

|

|

A merchandising company carries inventory for resale known as Merchandise Inventory. |

|

A manufacturing company carries three types of inventory:

| • |

Direct Materials Inventory |

| • |

Work-In-Process Inventory |

| • |

Finished Goods Inventory |

|

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

|

7. SMALL BUSINESS EXAMPLE

INCOME STATEMENT FOR A SERVICE COMPANY |

|

|

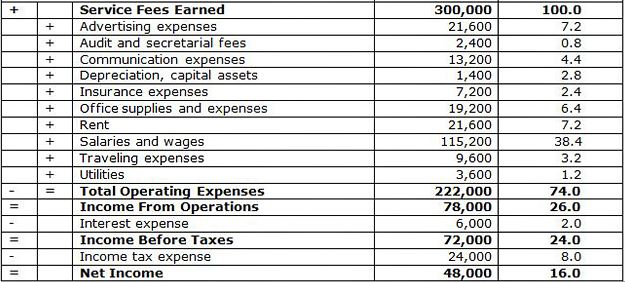

INCOME STATEMENT FOR A SERVICE COMPANY |

Balance Sheet

For ABC Service Company, Inc.

For Period: January 1, 2013 - December 31, 2013

|

|

|

|

8. SMALL BUSINESS EXAMPLE

INCOME STATEMENT FOR A MERCHANDISING COMPANY |

|

|

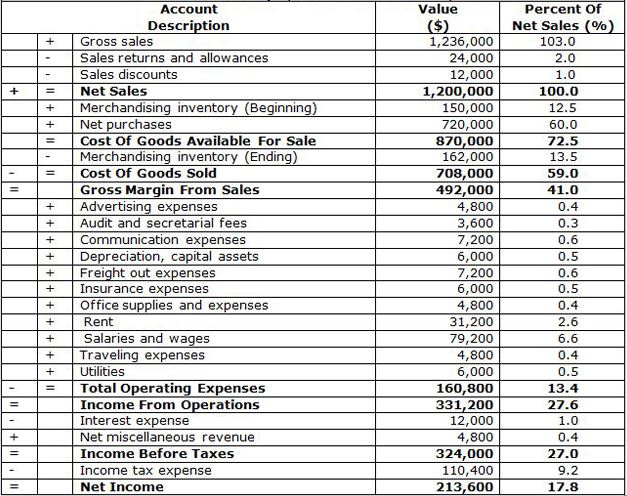

INCOME STATEMENT FOR A MERCHANDISING COMPANY |

Income Statement

For ABC Merchandising Company, Inc.

For Period: January 1, 2013 - December 31, 2013

|

|

|

|

|

9. STATEMENT OF COST OF GOODS MANUFACTURED |

|

|

STATEMENT OF COST OF GOODS MANUFACTURED |

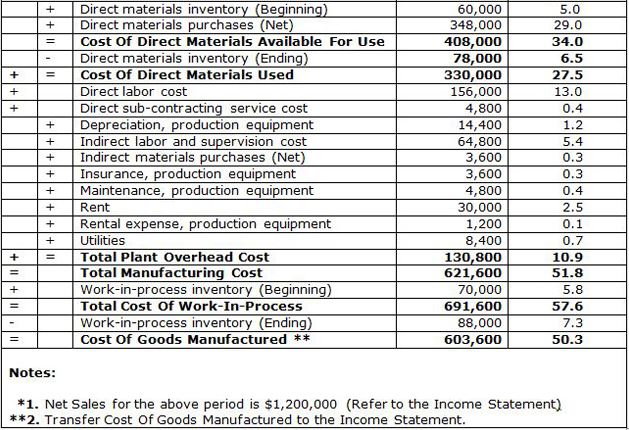

Additional information pertinent only to manufacturing companies is included in the Statement Of Cost Of Goods Manufactured, also known as Cost Of Goods Statement, or COGS.

The main purpose of this statement is to summarize all manufacturing costs incurred during a specific accounting period and to establish the cost of goods manufactured. This cost will be subsequently transferred into the income statement to determine the net income for a manufacturing company during a specified accounting period. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

|

10. SMALL BUSINESS EXAMPLE

STATEMENT OF COST OF GOODS MANUFACTURED |

|

|

STATEMENT OF COST OF GOODS MANUFACTURED |

Cost Of Goods Manufactured Statement

For ABC Manufacturing Company, Inc.

For Period: January 1, 2013 - December 31, 2013

|

|

|

|

11. SMALL BUSINESS EXAMPLE

INCOME STATEMENT FOR A MANUFACTURING COMPANY |

|

|

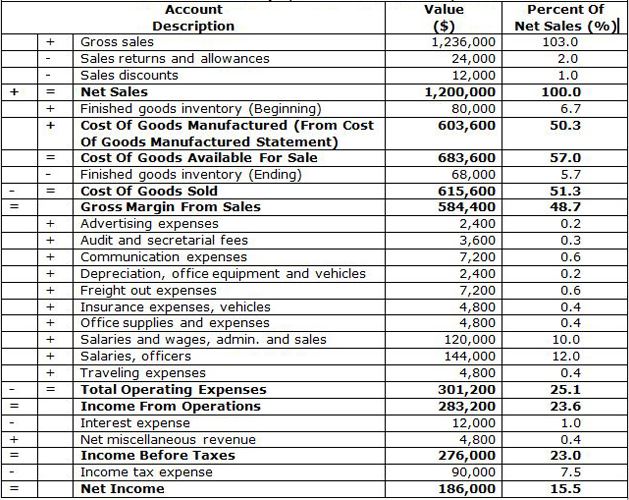

INCOME STATEMENT FOR A MANUFACTURING COMPANY |

Income Statement

For ABC Manufacturing Company, Inc.

For Period: January 1, 2013 - December 31, 2013

|

|

|

|

12. STATEMENT OF CASH FLOWS |

|

|

STATEMENT OF CASH FLOWS |

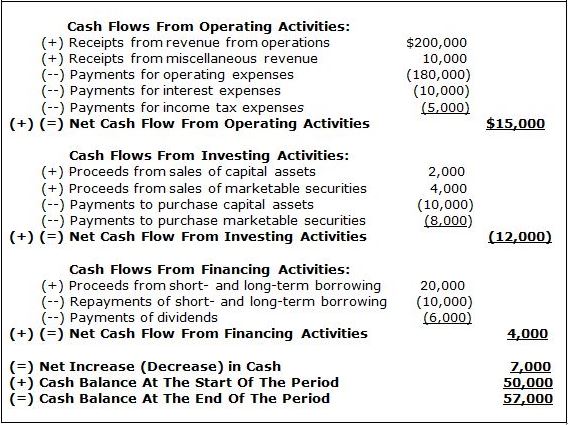

A Statement Of Cash Flows is the third important financial statement, which summarizes all receipts and payments of funds by an organization during a specified accounting period.

The statement of cash flows reflects the movement of funds as a result of all operating, investing, and financing activities of the organization. The structure of a statement of cash flows does not depend upon the type of operations, i.e. service, merchandising, or manufacturing company may have a similarly structured statement of cash flows.

A simplified example of statement of cash flows is presented below. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

|

13. SMALL BUSINESS EXAMPLE

STATEMENT OF CASH FLOWS |

|

|

STATEMENT OF CASH FLOWS |

Statement Of Cash Flows

For ABC Company, Inc.

For Period: January 1, 2013 - December 31, 2013

|

|

|

|

14. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

15. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

Whatever You Do Today Will Definitely Show Up Tomorrow! |

| |

|