FINANCIAL MANAGEMENT

CHECK POINT 53: CREDIT CONTROL

This Check Point Is Available By Subscription Only,

But You Can Still Check Out The Menu Below. |

|

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

FINANCIAL MANAGEMENT

CHECK POINT 53: CREDIT CONTROL

Please Select Any Topic In Check Point 53 Below And Click. |

|

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 53 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 53? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about Credit Control and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• About three important elements of credit control.

• About credit control objectives.

• About sources of credit information.

• About credit application form.

• About the trade reference inquiry questions.

• About credit control procedures.

• About cash discount structure.

• About credit control policies.

• About monthly statement of account and debtors' age analysis report.

• About payment collection letter... and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 53 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. ELEMENTS OF CREDIT CONTROL |

|

|

CREDIT CONTROL |

Business owners and financial managers must be fully familiar with all elements of effective credit control procedures to ensure financial stability and profitable performance of the organization.

One of the most important financial management tasks is to develop, implement, and maintain sound credit control procedures related to business transactions with the company's customers.

Generally, Credit represents the authority to obtain finance, materials, and services on the basis of a promise to pay for them at a certain date in the future. Many business transactions often take place on a credit basis and necessitate the development of a stringent Credit Control.

Most companies follow a set policy of credit control governing the amounts of credit that may be granted to customers, or Trade Debtors, as well as the period allowed for the repayment of such amounts, known as Accounts Receivable, or the Book (of accounts receivable).

All Credit Transactions have three important elements illustrated below. |

THREE IMPORTANT ELEMENTS OF CREDIT CONTROL |

|

|

|

|

|

| Future Payment |

|

Confidence |

|

Risk |

|

|

| |

| The credit control process can be maintained manually or by using a specific accounting software program. |

| |

| POPULAR ACCOUNTING SOFTWARE PROGRAMS |

| There are several excellent Accounting Software Programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

|

• Sage One

• QuickBooks Intuit

• FreshBooks

• Harvest Software Systems

• NetSuite

|

| Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

2. CREDIT CONTROL OBJECTIVES |

|

|

REASONS FOR CREDIT CONTROL |

Unfortunately, there is always a certain amount of risk involved in doing business on a credit basis. It may happen that a particular customer will not pay on the due date or not pay at all, leading to a Bad Debt. The main function of the Credit Controller is, therefore, to minimize the risk of financial exposure by the company at all times. Moreover, the credit controller must ensure that the element of confidence is supported by a practical policy of evaluating the ability of the company's customers to meet their payment commitments in a timely manner.

A sound Credit Policy usually has several important objectives outlined below. |

CREDIT CONTROL OBJECTIVES |

1. |

To minimize the amount of credit losses. |

2. |

To minimize the proportion of slow paying accounts. |

3. |

To maximize the contribution toward the profitability of the organization. |

4. |

To ensure effective evaluation of customers' credit rating. |

5. |

To define the conditions of credit covering maximum value, credit period, and cash discounts. |

6. |

To ensure efficient collection of outstanding accounts with some flexibility particularly with respect to valued customers. |

|

|

|

3. SOURCES OF CREDIT INFORMATION |

|

|

CREDIT INFORMATION |

One of the main tasks of credit control is to establish a correct rating for all customers through obtaining suitable information from various sources. Some of the major Sources Of Credit Information are outlined below. |

SOURCES OF CREDIT INFORMATION |

1. |

Information provided by the prospective customer. |

2. |

Credit ratings published by Dun & Bradstreet and other reputable agencies. |

3. |

Banker's references, usually obtained through the company's bank. |

4. |

Trade references provided by the prospective customers. |

5. |

References from trade associations. |

6. |

Financial statements provided by prospective customers. |

|

| |

ADDITIONAL INFORMATION ONLINE |

You can obtain updated credit information about various companies provided by Dun & Bradstreet online. |

|

|

4. CREDIT APPLICATION FORM |

|

|

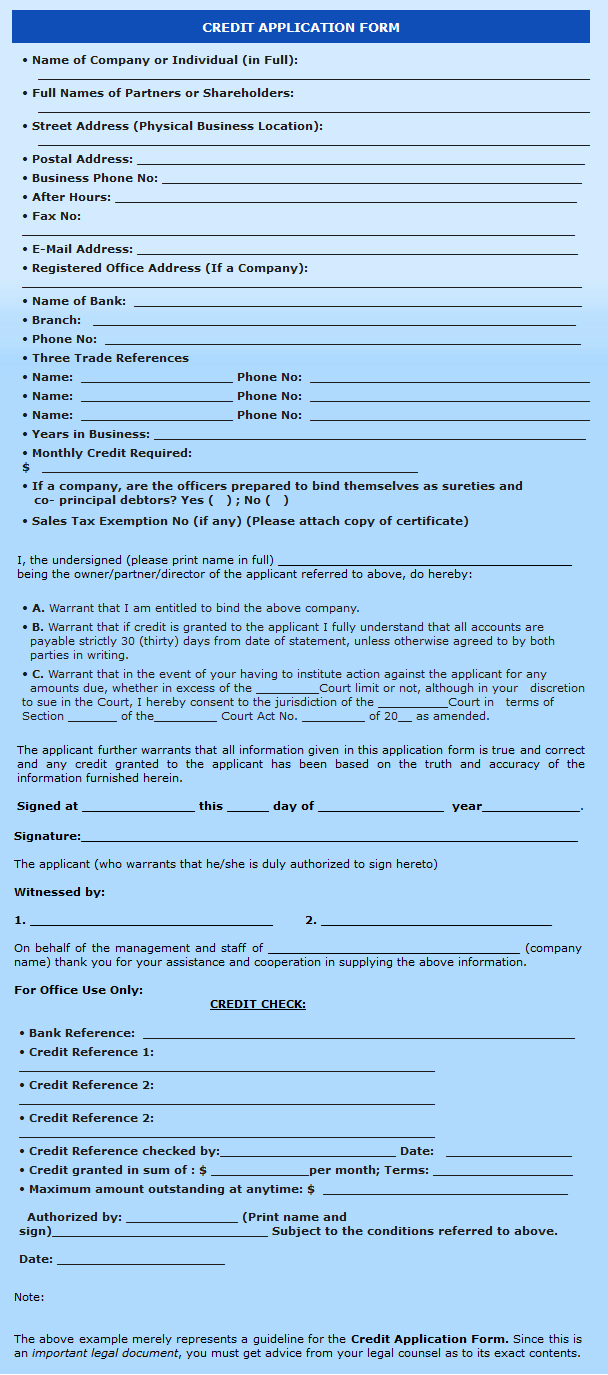

CREDIT APPLICATION FORM |

The first step in obtaining information about the prospective customer entails completion of the Credit Application Form. An example of a credit application form, illustrated below, must be completed by the prospective customer's financial manager. All information supplied by the prospective customer must be treated with utmost confidentiality.

Once the credit application form is submitted to the company, all information contained therein needs to be thoroughly checked by the credit controller. This entails approaching each trade reference and verifying information provided by the prospective customer. The Trade Reference Inquiry is based on evaluating answers to several questions outlined below. |

THE TRADE REFERENCE INQUIRY QUESTIONS |

1. |

How long has the subject of inquiry (prospective customer) been known to you? |

2. |

If a recently opened account, were satisfactory references given? |

3. |

What amount of credit do you allow to the subject of inquiry? |

4. |

What are your credit terms? |

5. |

Are payments made regularly and in accordance with your terms? |

6. |

Is there any additional information pertaining to the subject of inquiry? |

|

|

|

5. CREDIT APPROVAL PROCEDURES |

|

|

CREDIT APPROVAL PROCEDURES |

Upon obtaining Trade References and verifying information provided by the prospective customer, the Credit Controller needs to decide whether the credit should be approved. If the credit is approved, the maximum amount of credit, terms of repayment, and securities required from the prospective customer must be specified. Once appropriate securities are obtained and credit terms are accepted by the prospective customer, both companies may begin a normal trading relationship.

Credit Terms And Conditions imposed by the company do not have to be the same for every customer. It is advisable, in fact, to maintain sufficiently flexible terms to ensure a continuous flow of business. Such terms should be specifically applied to the most valuable customers, i.e. those who place significant purchase orders on a continuous basis and pay regularly. |

ADDITIONAL INFORMATION ONLINE |

|

|

|

6. CASH DISCOUNT STRUCTURE |

|

|

CASH DISCOUNT STRUCTURE |

Sometimes a company may require immediate payment upon the delivery of goods or services to customers. In this case, the transaction takes place on a Cash On Delivery (COD) basis.

Many companies also offer Cash Discounts to their customers to stimulate payments of accounts receivable within a specified period of time. A few typical examples of Cash Discount Structures are illustrated below. |

EXAMPLES OF A CASH DISCOUNT STRUCTURE |

|

|

|

|

|

| 5% On COD |

|

2.5% On 30 Days |

|

Net On 60 Days |

Cash discount of 5% if payment is received on a COD basis. |

|

Cash discount of 2.5% if payment is received within 30 days from the delivery date. |

|

No cash discount if the payment is received within 60 days from delivery date. |

|

|

|

|

7. SMALL BUSINESS EXAMPLE

CREDIT APPLICATION FORM |

|

|

|

|

8. CREDIT CONTROL POLICIES |

|

|

CREDIT CONTROL POLICIES |

All activities related to credit control must be carried out strictly in accordance with the Credit Control Policy established by management. Irrespective of the particular credit terms offered to customers, all outstanding accounts should be continuously monitored and the following measures should apply. |

GUIDELINES FOR CREDIT CONTROL POLICIES |

1. |

Customers' credit ratings must be evaluated prior to the granting of credit. |

2. |

All transactions between the company and its customers must be recorded in the appropriate books of account. |

3. |

Monthly statements of account must be forwarded to all customers. |

4. |

Contact with customers should be on a continuous basis to ensure agreement on the outstanding balances. |

5. |

Outstanding amounts must be collected promptly. |

6. |

Unpaid balances must be red-flagged, and investigated on an individual basis with each respective customer. |

|

|

|

9. MONTHLY STATEMENT OF ACCOUNT |

|

|

MONTHLY STATEMENT OF ACCOUNT |

Accounts Receivable represent an important part of the company's current and liquid capital and it is essential to ensure their timely collection. The first step in ensuring timely collection of accounts receivable entails preparing a monthly statement of account for each customer.

The Monthly Statement Of Account summarizes the dates, invoices, and amounts that reflect customers' purchases during a particular month. In addition, all outstanding amounts are summarized in accordance with the outstanding period of time, ranging from 1 to 90 days or more. A typical Monthly Statement Of Account for a specific customer is presented below. |

|

|

10. SMALL BUSINESS EXAMPLE

MONTHLY STATEMENT OF ACCOUNT |

|

|

MONTHLY STATEMENT OF ACCOUNT |

To: XYZ Corporation, Inc.

Address: |

Your Account With Us: No.2000 |

Date: September 30, 2013 |

Date |

Our Invoice No. |

Your

Order

No. |

Amount |

Terms |

09.01.2009 |

123 |

450 |

$2,000.00 |

COD |

09.10.2009 |

145 |

470 |

1,600.00 |

5% on COD |

09.20.2009 |

156 |

480 |

1,300.00 |

Net 60 Days |

09.25.2009 |

167 |

490 |

200.00 |

COD |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

Outstanding Balance |

Total

Amount |

Payment Instructions |

1-30

Days |

31-60

Days |

61-90

Days |

91 Days-Over |

$5,100.00 |

$2,400.00 |

$1,000.00 |

$300.00 |

$8,800.00 |

Please remit $1,300.00 which is 60 days overdue. |

Our Terms Are: 5% COD, 2.5% on 30 Days, and 60 Days Net.

Thank you very much for your business. |

|

|

|

11. MONTHLY DEBTORS AGE ANALYSIS REPORT |

|

|

MONTHLY DEBTORS AGE ANALYSIS REPORT |

Once all Monthly Statements are prepared, each statement must be immediately sent to the appropriate customer.

Moreover, all details related to outstanding amounts owed by the customers must be entered into the Monthly Debtors Age Analysis Report. Each report summarizes all customers accounts in accordance with the outstanding period of time, ranging from 1 to 90 days or more. A typical Monthly Debtors Age Analysis Report is presented below. |

|

|

12. SMALL BUSINESS EXAMPLE

MONTHLY DEBTORS AGE ANALYSIS REPORT |

|

|

MONTHLY DEBTORS AGE ANALYSIS REPORT |

ABC Corporation, Inc.

Debtors Age Analysis Report On September 30, 2013 |

Debtor |

Outstanding Period (In Days) |

Total Amount |

|

1-30 |

31-60 |

61-90 |

91- Over |

Customer 1 |

1,200.00 |

0 |

500.00 |

500.00 |

2,200.00 |

Customer 2 |

1,000.00 |

1,000.00 |

0 |

1,000.00 |

3,000.00 |

Customer 3 |

0 |

2,000.00 |

0 |

0 |

2,000.00 |

Customer 4 |

1500,00 |

1,500.00 |

300.00 |

0 |

3,300.00 |

Customer 5 |

200.00 |

500.00 |

2,000.00 |

2,000.00 |

4,700.00 |

Customer 6 |

500.00 |

1,000.00 |

3,000.00 |

0 |

4,500.00 |

Total |

4,400.00 |

6,000.00 |

5,800.00 |

3,500.00 |

19,700.00 |

|

|

|

13. PAYMENT COLLECTION LETTERS |

|

|

PAYMENT COLLECTION LETTERS |

Additional measures that sometimes need to be undertaken by the credit controller entail sending Payment Collection Letters to those customers who do not pay on time. Payment collection letters usually consist of three different types outlined below. |

THREE TYPES OF PAYMENT COLLECTION LETTERS |

1. |

An Overdue Account Letter.

This is the first measure to be applied to customers who may be late with their payment. The overdue account letter must specify the dates, invoice numbers, amounts which are in arrears, and include a request for payment within seven days. |

2. |

A Final Reminder Letter.

This letter should be sent if no response has been received to the previous one. The final reminder letter must emphasize that the customer's failure to comply with credit conditions offered by the company may jeopardize future supplies. Moreover, the letter should contain a request for immediate payment. |

3. |

A Final Demand Letter.

This letter should be sent by certified mail if no response has been received on the previous one. The final demand letter must clarify that the customer's failure to comply with request for an immediate payment will result in legal action. Such action should be undertaken within seven days without further notice to the customer. Moreover, all deliveries and credit facilities should be suspended until the matter is resolved. |

|

Note:

You should obtain advice from your legal counsel as to the exact wording of your company's collection letters. |

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

14. CREDIT CONTROL REVIEW |

|

|

CREDIT CONTROL REVIEW |

Another function of the credit controller is to conduct a Credit Control Review of existing credit terms granted by the company to its customers. Credit control review should be carried out on a regular basis, possibly once every six month, and should include the following details outlined below. |

ELEMENTS OF A CREDIT CONTROL REVIEW |

1. |

Name Of The Customer.

Who is the customer? |

2. |

Size Of The Customer's Business.

Is it a small, medium-sized, or a large company? |

3. |

Business Period.

How long has the customer been purchasing from the company? |

4. |

Credit Risk.

Does the company present a good, fair, or questionable credit risk? |

5. |

Current Credit.

What is the current credit limit and actual amount outstanding? |

6. |

Annual Business Volume.

How much does the customer buy or may buy in the future? |

7. |

Payment Period.

What is the average payment period by the customer during this year? |

|

| |

WHAT SHOULD YOU DO NEXT? |

Once each aspect of the history of business relations between the company and a particular customer is thoroughly examined, Final Conclusions may be reached. By reaching such conclusions, the credit controller will be in a better position to decide whether to increase or to reduce credit terms offered to the customer. |

|

|

15. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

16. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

No Man's Credit Is As Good As His Money!

Edgar Watson Howe, Publisher

|

Go To The Next Open Check Point In This Promotion Program Online. |

| |

|